Choice of taxation system. Accounting, tax accounting and reporting in HOA Accounting HOA who can keep records

Hello.

According to Art. 155 Housing Code of the Russian Federation

Article 155. Payment for residential premises and utilities

6. Owners of premises in an apartment building in which a homeowners association or housing cooperative or other specialized consumer cooperative is not a member of a homeowners’ association or a housing cooperative or other specialized consumer cooperative shall pay fees for the maintenance of residential premises and fees for utilities in accordance with with agreements concluded with a homeowners’ association or a housing cooperative or other specialized consumer cooperative, including paying contributions for major repairs in accordance with Article 171 of this Code.

That is, a non-member of TSN naturally has an obligation to pay contributions. Despite the fact that cottage villages are not specified separately in the legislation.

I will give here information from an expert article:

From the point of view of the law, the composition of the members of the HOA should be the same as the composition of the owners of premises (residential buildings) in the village, since the HOA is created by collecting 100% of the votes of the residents. This is probably why the legislator refused to regulate the holding of general meetings in cottage villages.

At the same time, it is reliably known that on the territory of the country many HOAs created with violations continue to operate, in which only a part of the residents of the villages managed by such HOAs are members.

In this regard, the question of whether the decisions of the HOA in a cottage community are binding for persons who are not members of this HOA becomes especially relevant. The answer to this question is especially interesting in terms of charging for the maintenance of common property and utilities.

On the one hand, the Housing Code of the Russian Federation directly stipulates that all owners of premises must comply only with the decisions of the general meeting of owners (and not the general meeting of HOA members). Moreover, this rule applies only to apartment buildings. So, paragraph 5 of Art. 45 of the RF Housing Code establishes that the decision of the general meeting of premises owners is mandatory for all owners of premises in an apartment building, including those owners who did not participate in the voting.

Clause 6 of Art. 155 of the Housing Code of the Russian Federation, which requires persons who are not members of the HOA to pay fees for the maintenance of residential premises and fees for utilities in accordance with agreements concluded with the HOA (which actually implies payment of fees to the HOA itself), also applies only to apartment buildings.

At the same time, the Housing Code of the Russian Federation orders the owners of residential buildings to pay a fee in accordance with the agreement concluded with the person carrying out the relevant types of activities (clause 9 of Article 155). The above gives grounds to assume that it is mandatory to conclude an additional agreement with the HOA.

On the other hand, as an analysis of judicial practice shows, the position of defaulters who have not become members of the HOA does not yet have any prospects. The courts clearly side with the HOA, without delving into the intricacies of housing regulation and without paying attention to the fact that the legislation does not provide for cases of the presence in the village of owners of residential buildings who are not members of the HOA.

In this regard, the Appeal Ruling of the Moscow City Court dated July 8, 2016 in case No. 33-24614 is indicative.

This act considers the complaint of the defendant, who is the owner of a land plot on the territory of a cottage village, but is not a member of the HOA created in such a village. The defendant asks to cancel the decision of the lower court, which collected in favor of the plaintiff the debt for payment for living quarters and utilities.

In this case, the defendant, in particular, refers not only to the fact that he is not a member of the HOA in the village, but also to the absence of an agreement with the HOA, provided for in paragraph 9 of Art. 155 Housing Code of the Russian Federation.

However, the courts justify their position with the provisions of Art. 210 of the Civil Code of the Russian Federation and Art. 30 of the Housing Code of the Russian Federation, according to which the owner of the property is obliged to bear the burden of its maintenance, as well as Art. 153 of the Housing Code of the Russian Federation, according to which the obligation to pay for residential premises and utilities arises from the owner of the premises from the moment the ownership of such premises arises.

Moreover, according to the court, the absence of an agreement concluded between the parties does not relieve the defendant from bearing the burden of maintaining the property and paying for utilities.

An equally logical justification for this legal position is given in the Appeal ruling of the St. Petersburg City Court dated 04/09/2015 N 33-3442/2015, in which the court noted that a different approach would lead to the possibility of the owner creating unjust enrichment at the expense of other owners and the created them partnerships.

In addition, we also note that the Constitutional Court of the Russian Federation considered the issue of the legality of the partnership demanding payment from persons who are not members of the HOA (specifically in cottage villages), and this issue was resolved positively (see Determination of the Constitutional Court dated October 27, 2015 N 2471-O ).

At the same time, TSN’s obligation to provide non-members with documents that directly indicate the legality of establishing the appropriate fee arises from the general obligations of the contractor in relation to the consumer of services in accordance with the Law “On the Protection of Consumer Rights”.

That is, you should request in writing information about the establishment of tariffs and the procedure for calculating them in writing, and if you refuse to provide them, appeal this refusal in court.

Many owners of urban real estate located in apartment buildings decide to create an HOA. This is done not only to optimize utility costs, but also to maintain residents’ property in proper technical condition. Each partnership of real estate owners must be organized in accordance with the regulations of Federal law. At the same time, the HOA is required to maintain accounting records and submit reports generated based on the results of the reporting periods to the tax office.

Features of creating an HOA

The main purpose of creating an HOA is the following:

- effective management of real estate, which legally belongs to the participants of the partnership;

- timely repair and maintenance of utilities;

- calculation of utilities according to real and not inflated tariffs;

- improvement of the area adjacent to apartment buildings, etc.

Federal law does not prohibit property owners' associations from engaging in commercial activities whose purpose is to generate income. In this case, we are not talking about running a business in its direct sense, but about providing small services on a paid basis for the participants of the partnership:

- construction of additional real estate;

- advertising placement;

- rental of real estate;

- carrying out repair work, etc.

When concluding any agreements, the management of the HOA must respect the interests of the homeowners. All proceeds received go to the current account of the partnership. After this, the funds are distributed to special funds. The HOA can spend it only in those areas that were reflected in the statutory documentation approved by all property owners. All funds that will be credited to the current account in the form of membership fees can only be used to pay for utilities, as well as to maintain real estate in proper technical condition.

Russian legislation allows not only owners of city apartments to unite in HOAs, but also owners of private houses located on adjacent land plots.

The procedure for generating funds

Accounting in an HOA involves recording all transactions that are directly or indirectly related to the partnership. The specialist who will be entrusted with accounting is required to draw up primary documentation, the data from which must be posted to the appropriate registers.

When organizing accounting in a partnership, incoming funds from which capital is formed must be registered in a separate accounting register:

- contributions to ;

- receipts in the form of entrance and membership fees;

- penalties for late paid utilities (the full amount of rent is not included);

- subsidies;

- the difference between received utility payments and their actual cost;

- income received while conducting commercial activities, etc.

How should utility bills be accounted for?

If utility payments have been accrued to the owners of real estate, they must be reflected in the appropriate accounting accounts. The difference that arises between the actual and nominal cost of utility bills is subject to taxation at rates approved by current legislation. If payment for utility services is received into the current account from property owners who have not entered into a partnership and have not entered into an agreement with it for the provision of agency services, then the HOA accounting department must accrue taxes on them in full.

Features of accounting

Features of accounting in HOAs are as follows:

- Based on the results of the reporting period (as a rule, this is a calendar year), financial statements of the HOA are compiled, which are transferred to the members of the partnership for study. The reports must contain reliable information from which property owners can learn about the activities of the partnership, as well as what profit the HOA made.

- Accountants prepare an estimate of expenses and income for the next year, which must be approved at a general meeting of members of the partnership. In the future, it is this document that specialists will rely on when maintaining accounting and tax records in the HOA.

- Information related to the execution of the approved estimate for the reporting period must be posted on the official website of the HOA. The responsibility for checking such estimates is assigned by Federal legislation to the housing supervision inspection (territorial).

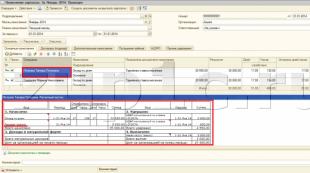

Basic accounting entries in the HOA:

| Debit | Contents of business transactions | Credit |

|---|---|---|

| 76 | Debt in contributions, which is registered with a member of the company | 86 |

| 62 | Debt owed by the owner of a property who refused to join the company | 90 |

| 26 | Expenses that arise during the maintenance of property owned by the company | 70, 69, 02, 10 |

| 26 | Tax calculation under the simplified taxation system | 68 |

| 26 | Costs incurred by the partnership in maintaining its premises in proper technical condition, as well as payment for the services of third-party organizations providing their maintenance | 60 |

| 86, 20 | Distribution of society's costs associated with property maintenance among property owners who have refused membership in the HOA | 26 |

| 90 | Write-off of costs incurred by the company for the maintenance of property that is not the property of the HOA participants | 20 |

| 90 | Expenses associated with servicing the current account, accrued commissions, etc. | 51 |

| 99 | Carrying out balance sheet reformation if the company made a profit based on the results of the reporting period | 84 |

| 84 | Use of the company's retained earnings for targeted financing | 86 |

| 76, 62 | Presentation of company losses for compensation | 84 |

| 86, 20 | Creation of a special fund, the funds of which can be spent on repair work | 96 |

Accounting entries of a partnership operating on the simplified tax system:

| Debit | Contents of business transactions | Credit |

|---|---|---|

| 76 | Accrual of mandatory contributions to members of the company, which must be made within the time limits approved at the general meeting, in particular contributions that are submitted by all owners for major repairs | 86 |

| 50, 51 | Receipt of contributions from property owners to the current account or cash desk (with the exception of contributions for major repairs, since these amounts must be accumulated in a special account) | 76 |

| 55 | Receipt of contributions from members of the society intended for major repairs | 76 |

| 20, 26 | Reflects the costs of the current period that are associated with the maintenance and management of HOA property | 60, 76 |

| 86 | The costs incurred by the company in managing and maintaining the property are written off (the costs were borne from funds from the fund created for targeted financing) | 20, 26 |

How are reports generated and submitted?

Accounting in HOAs requires the mandatory generation of reports that must be submitted both to the Federal Tax Service and to statistical authorities and extra-budgetary funds. Accounting statements in such partnerships are prepared for the year (even if the HOA does not carry out commercial activities and is on the simplified tax system), and includes:

- Balance.

- Report on the intended use of funds.

- Register of members of the partnership.

- Income statement.

In addition to accounting reports, the partnership must submit the following forms related to the calculation and payment of wages:

If the activities of the HOA are carried out on a simplified basis, then it is necessary to submit a corresponding declaration to the Federal Tax Service. It is worth noting that HOAs under the simplified tax system are exempt from paying the following taxes:

- at a profit;

- on property;

Taxation under the simplified tax system provides for the opportunity for a partnership to independently determine its own rate:

- A 6% rate is applied to income.

- A rate of 15% is applied to the difference between income and expenses.

The HOA on OSNO is obliged to accrue and pay to the budget all taxes and fees provided for by law, as well as submit the relevant declarations to the regulatory authorities. For late submission of reports, the responsible persons of the partnership will be subject to penalties and interest.

Taxation

Each HOA created by the owners of real estate has the right to independently choose a taxation system for itself. Federal legislation provides for the following tax regimes for such partnerships:

- BASIC.

During the process of state registration of an HOA, its owners can choose a simplified taxation system. If they do not indicate this in the appropriate application, the HOA will be automatically transferred to the general taxation system. Specialized Internet resources contain step-by-step instructions that will allow property owners to avoid mistakes when carrying out registration activities.

When determining the tax base, accountants of such partnerships must clearly distinguish which of the funds received can be considered income and which will not be taxed. If funds from property owners in the form of contributions for major repairs are transferred to the current account, they will not be subject to taxation. But, at the same time, if funds for the same purposes come from property owners who refused to join the HOA, then they will be considered income of the partnership.

All funds received to the accountant's current account or to the cash desk of the accountant's partnership must be accounted for separately. Also, separate records should be kept in the appropriate registers of all costs that were incurred at the expense of earmarked revenues. Based on the results of each period, accountants must prepare reports that are submitted to regulatory authorities. They must transfer all taxes to the budget within the deadlines established by law. If the requirements of the Tax Code of the Russian Federation are violated, penalties will be applied to the HOA.

You can read more about NPO reporting in the article what kind of reporting does an NPO submit?

Accounting (financial) reporting

Homeowners' association, TSN (represented by the board) are obliged to keep accounting records and prepare financial statements. This is stated in paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ and paragraph 7 of Article 148 of the Housing Code of the Russian Federation, letter of the Ministry of Construction of Russia dated April 10, 2015 No. 10407-ACh/04. This applies to both partnerships using the general taxation system and the simplified one (Law No. 402-FZ dated December 6, 2011, information from the Russian Ministry of Finance No. PZ-10/2012, letter from the Russian Ministry of Finance dated March 27, 2013 No. 03-11 -11/117). At the same time, when forming accounting (financial) reporting indicators, it is necessary to take into account the recommendations of the Ministry of Finance of Russia set out in Information No. PZ-1/2015.

The composition of the homeowners association (TSN) reporting depends on whether the partnership enjoys the right to conduct accounting in a simplified manner or not.

The partnership maintains accounting in a general manner

The annual accounting (financial) statements of the HOA (TSN), which maintains accounting in a general manner, consists of the Balance Sheet, the Report on the intended use of funds and appendices to them (clause 2 of Article 14 of the Law of December 6, 2011 No. 402-FZ) .

The appendices to the Balance Sheet are the Statement of Changes in Capital, the Statement of Cash Flows and, compiled in text and (or) tabular forms. This conclusion follows from paragraphs 2 and 4 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Thus, the annual accounting (financial) statements of the HOA (TSN) include:

- How to complete the statement of changes in equity ;

- Report on the intended use of funds.

The interim accounting (financial) statements of the HOA (TSN) consist of the Balance Sheet.

The partnership maintains accounting in a simplified manner

Homeowners' associations, TSN (as non-profit organizations) have the right to apply a simplified accounting procedure (clause 2, part 4, article 6 of the Law of December 6, 2011 No. 402-FZ). For those partnerships that exercise this right, the financial statements consist of the following:

- Financial results report ;

- Report on the intended use of funds.

Moreover, you need to use the simplified forms of these documents given in Appendix 5 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

For more information on preparing financial statements, see What documents should be submitted as part of the financial statements? .

Tax reporting

Homeowners' association (TSN) tax reports must be submitted. Regardless of the taxation system applied, the partnership is required to submit to the tax office information on the average number of employees (regardless of their presence), as well as submit certificates in Form 2-NDFL (for each employee who received income) and calculations in Form 6-NDFL.

For more information on this topic, see:

- What rights and responsibilities do taxpayers have? ;

Otherwise, the composition of tax reporting depends on the taxation system that the partnership applies.

Tax reporting: OSNO

Homeowners' associations (TSN) are required to submit an income tax return, since this obligation does not depend on the availability of taxable income in the current reporting (tax) period. This conclusion follows from Article 246 and paragraph 1 of Article 289 of the Tax Code of the Russian Federation.

If you have income subject to income tax, prepare and submit a declaration according to the general rules.

If the HOA (TSN) does not have an obligation to pay income tax, submit the declaration once a year and in a simplified form. The simplified income tax return form consists of the following sheets:

- Title page (sheet 01);

- Calculation of corporate income tax (sheet 02);

- Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing (sheet 07);

- Appendix No. 1 to the tax return.

This follows from Article 285 and paragraph 2 of Article 289 of the Tax Code of the Russian Federation, paragraph 1.2 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Homeowners' association (TSN) in the general taxation system is recognized as a VAT payer (clause 1 of Article 143 of the Tax Code of the Russian Federation). Therefore, take VAT declaration the partnership is obliged (clause 1 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

As for other tax returns, the obligation to submit them depends on whether the partnership has an object subject to the corresponding tax.

Tax reporting: simplified tax system

Homeowners' associations (TSN) in a simplified manner are recognized as single tax payers (clause 1 of Article 346.12 of the Tax Code of the Russian Federation).

Consequently, the partnership is obliged to annually submit to the tax office a declaration on the tax paid in connection with the application of the simplified taxation system. Moreover, the obligation to submit a declaration does not depend on the presence in the current year of income and expenses recognized under simplification. This conclusion follows from the provisions of paragraph 1 of Article 346.19 and paragraph 1 of Article 346.23 of the Tax Code of the Russian Federation.

In addition, a simplified partnership needs to keep a book of income and expenses. This is stated in Article 346.24 of the Tax Code of the Russian Federation and paragraph 1.1 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

For more information on this topic, see:

- How to draw up and submit a single tax return under simplification ;

- How to keep a book of income and expenses when simplified .

Homeowners' associations (TSN) on a simplified basis are not recognized as payers of income tax, property tax and VAT (clause 2 of Article 346.11 of the Tax Code of the Russian Federation). Consequently, the Homeowners Association (TSN) is not required to submit declarations for the listed taxes. An exception is provided for partnerships that have property for which the tax base is determined as the cadastral value (Clause 2 of Article 346.11 of the Tax Code of the Russian Federation). On such property you will need to pay taxes and submit a declaration in general order. As for other tax returns, the obligation to submit them depends on whether the partnership has an object subject to the corresponding tax.

Reporting on insurance premiums

Since the Homeowners Association (TSN) to carry out its statutory activities attracts hired employees, whose wages are included in annual estimate of income and expenses of the HOA (TSN) , the partnership, in relation to its personnel, acts as an insurer for compulsory pension (social, medical) insurance (Article 6 of the Law of December 15, 2001 No. 167-FZ, Article 2.1 of the Law of November 29, 2006 No. 255-FZ, Art. 11 of the Law of November 29, 2010 No. 326-FZ).

It should be noted that simplified partnerships can use reduced insurance premium rates , if real estate management is theirs main activity (subparagraph 8 part 1 and part 3.4 article 58 of the Law of July 24, 2009 No. 212-FZ, subparagraph 8 part 4 and part 12 article 33 of the Law of December 15, 2001 No. 167-FZ ). At the same time, mandatory payments by premises owners for the maintenance and repair of common property and for utilities are included in the income from the activities of the HOA (TSN) in managing real estate. Similar clarifications are contained in the letter of the Ministry of Health and Social Development of Russia dated March 22, 2012 No. 800-19 (sent for use in work by the letter of the Federal Social Insurance Fund of Russia dated April 3, 2012 No. 15-03-18/08-3638).

Homeowners' associations (TSN), like other insurers, are required to submit appropriate reports on insurance premiums (Clause 2, Article 14 of the Law of December 15, 2001 No. 167-FZ, Article 4.8 of the Law of November 29, 2006 No. 255-FZ , clause 11 of article 24 of the Law of November 29, 2010 No. 326-FZ).

Statistical reporting

Non-profit organizations are responsible for compiling statistical reporting. This is stated in paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ. Consequently, homeowners' associations (TSN), along with other organizations, must report to the statistical authorities.

Disclosure of information implies ensuring access to it by an unlimited number of persons (clause 2 of the Standard approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731). For the composition of the disclosed information, see table.

The homeowners association (TSN) is obliged to disclose information by posting it:

- Online www.reformagkh.ru;

- on one of the following websites: an authorized regional department or local government body;

- on information stands located in an apartment building.

The forms on which information must be posted are approved by the Ministry of Construction of Russia (clause 8 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731). The current forms are given in the order of the Ministry of Construction of Russia dated December 22, 2014 No. 882/pr.

The procedure for disclosing information about your activities on the site www.reformagkh.ru is set out in the Regulations approved by order of the Ministry of Regional Development of Russia dated April 2, 2013 No. 124. At the same time, newly created TSN must disclose information no later than 30 calendar days from the date of state registration (clause 9 of the Standard approved by the Decree of the Government of the Russian Federation dated September 23, 2010 No. 731).

Information on the activities of organizations managing apartment buildings must be available for 5 years. If changes are made to the disclosed information, publish them in the same sources (on the Internet - within 7 working days, on stands - within 10 working days).

This is stated in paragraphs 5.1, 6, 15 and 16 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731.

In addition, the HOA (TSN) is obliged to provide information in written (electronic) form upon requests from interested parties. The procedure for disclosing information through requests is set out in paragraphs 17–23 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731.

Responsibility for non-disclosure of information

For violation of legal requirements on the disclosure of information on the management of an apartment building, administrative liability is provided (Article 7.23.1 of the Code of Administrative Offenses of the Russian Federation).

The penalty is a fine. In this case, the amount of the fine is:

- from 250,000 to 300,000 rubles. – for the organization;

- 30,000 to 60,000 rub. – for officials (and in case of repeated violation - disqualification for a period of 1 to 3 years).

The decision to create a cooperative partnership is made by homeowners collectively, through voting.

The activities of the HOA as a legal entity are regulated by the Housing Code of the Russian Federation and federal legislative acts. In matters of taxation, it is necessary to be guided by the Tax Code of the Russian Federation.

Does the HOA pay taxes or not?

Despite the fact that the association of owners of residential premises is not a business entity, its managers are required to maintain standard accounting records and regularly make transfers to the state budget.

This is due both to the different nature of the financial resources coming to the accounts of the HOA, and to the fact that any organization of a similar profile always has hired employees on staff.

Accounting in the HOA is maintained on several accounts. For targeted funds, you must use the “Targeted Financing” account. Entrepreneurial activities are controlled in the “Sales” account.

You will learn about HOA taxation from the video:

Sources of financing

Among the main types of cash receipts to the HOA budget, in accordance with Art. 151 clause 2. Housing Code of the Russian Federation, we can highlight:

In this case, funds that have the nature of targeted financing are not taxable (Article 251 of the Tax Code of the Russian Federation). These include, for example, utility bills, money for major or current repairs, budget injections, etc.

HOAs are required to keep separate budget records when receiving targeted revenues. If it is not maintained, then such funds of financing are considered by the fiscal authorities as subject to taxation ().

Now that you know that HOA taxes are a reality and not a myth, let's talk about what exactly you have to pay for.

What taxes does the HOA pay?

If the HOA attracts hired employees, then in relation to them it acts as an insurer for social, pension and health insurance, which obliges the association to provide quarterly reports to the Pension Fund and the Social Insurance Fund.

Two tax systems for HOAs

Homeowners' associations have the right to apply both basic (OSNO) and simplified (STS) taxation schemes.

Homeowners' associations have the right to apply both basic (OSNO) and simplified (STS) taxation schemes.

Initially, all legal entities are in the general regime.

To switch to a preferential tax payment system, you must submit an application within the first 5 days after the association is registered for tax purposes.

Or in the period from October 1 to November 30 of the year that precedes the next reporting period from which the organization expects to switch to the simplified tax system.

BASIC

As already stated, it applies by default to all legal entities. Provides for the transfer of VAT, as well as fees on profits and tangible assets of the HOA.

Payments of wages to employees are accompanied by the transfer of insurance contributions to extra-budgetary funds (No. 212-FZ).

simplified tax system

A partnership can use the simplified tax system if:

- the average headcount of the company is 100 people;

- the value of assets and fixed assets does not exceed 100 million rubles;

- The amount of revenue of the HOA for 9 months, taking into account the deflator coefficient, is no more than 45 million rubles.

When switching to a simplified system, an association of homeowners can choose one of two tax objects:

- Total income (rate - 6%);

- Revenues to the budget minus expenses (rate - 15%, in case of a negative balance, a minimum fee of 1% is paid).

Under the simplified tax system, the taxpayer is exempt from paying VAT, as well as property and profit taxes. Transport and land duties are paid on a general basis.

Reporting nuances

It is mandatory for the HOA to submit reports to the tax authorities.

It is mandatory for the HOA to submit reports to the tax authorities.

Regardless of the chosen taxation system, representatives of the HOA must promptly transfer to the employees of the local branch of the Federal Tax Service:

- An income tax return (OSNO) or a simplified tax return (USN).

- VAT return (OSNO).

- Information on the average staff composition and certificates in form 2-NDFL (once a year for each employee) and 6-NDFL (once a quarter for the entire organization).

However, before switching to the simplified tax system, it is necessary to draw up an estimate and calculate what cash receipts can be qualified as targeted, how many expenses there will be, how much can be earned for the provision of paid services, etc.

After all, it may well turn out that such an attractive at first glance rate of 6% is in your case less profitable than 15%.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

A real estate owners' association is a relatively new form of non-profit organization.

It differs in its organizational and legal status and is created to unite property owners of various types.

What TSN is, what laws govern it and how this form of organization differs, you will learn after reading the article.

Article 123 of the Civil Code defines a partnership of real estate owners.

According to it, TSN is an association of real estate owners who, on a voluntary basis, create a partnership to organize joint ownership, use and disposal of real estate. It can also solve other problems that do not violate the law.

According to it, TSN is an association of real estate owners who, on a voluntary basis, create a partnership to organize joint ownership, use and disposal of real estate. It can also solve other problems that do not violate the law.

In this form, it is not only easier to keep records of real estate objects, but also to manage them. For example, residents who own apartments in an apartment building create a TSN to regulate cleanliness and order inside the building (lights on the floors, elevator operation, etc.) and in the area near it. Their goal is to provide comfortable living conditions.

This association is a legal entity whose members own real estate of the same type.

Partnership unites owners of any real estate:

- Premises (both residential and non-residential) in one building (or several).

- Residential or country houses.

- Dacha plots.

- Gardens or vegetable gardens.

Legislative regulation of the issue

Changes in the Civil Code that occurred in 2014 affected almost all owners (and not just legal entities), although the law does not oblige them to undergo the re-registration procedure.

TSN is regulated on the basis of the general legislative framework relating to real estate.

Among legislative acts related to this type of organization, the following are distinguished:

- Civil Code of the Russian Federation - articles 49, 65, 123, 174, 181,182 and 218.

- RF LC – Articles 135, 136, 143, 145, 149, 150, 152 and 161.

By the way, since 2014, there have been changes in the legislation, according to which SNT (horticultural non-profit partnerships) and (homeowners' partnerships) are now created in the form of TSN.

Functions, tasks and goals of the organization

Functions in TSN distributed as follows:

the main task such an association is the organization of collective use of real estate. Thanks to a property owners' association, owners can manage it themselves without involving third parties (for example,).

Rights and obligations

The legal capacity of a real estate owners' association is enshrined in the main document - the organization's charter.

This form of legal the person has specific, separate property, which, if necessary, will be used to meet the obligations assumed.

So participants are not responsible for the actions of the organization:

- Neither subsidiary.

- Not in solidarity.

- Not a share.

The partnership takes over duty for the formation of supervisory and management bodies created to coordinate and make decisions by its members and other legal entities (for example, to carry out construction work or connect to the housing and communal services network). The main governing body of the association must make decisions on establishing mandatory contributions for members of the organization.

TSN can carry out business activities and receive income from it (according to the Civil Code of the Russian Federation), but under two conditions:

- This activity must meet the goals of the association (as enshrined in the charter).

- Profits cannot be distributed among members of the organization.

All actions of the organization must correspond to its goals and objectives. At the association have rights:

If the participants do not fulfill their obligations as enshrined in the charter or the decision of the meeting, the partnership may try in court to force them to fulfill their obligations, make payments or contributions. Also, the organization, in court, can demand from violators compensation for losses caused due to failure of members to fulfill their obligations.

TNS obliged:

- Conduct its activities within the framework of the norms established by law, as well as in accordance with its charter.

- Conclude contracts with third parties to perform specific work.

- Fulfill your obligations and monitor the sanitary and technical condition of common property.

The owner becomes a member of TSN after he submits an application for entry there. You can leave the partnership by filing an application for withdrawal from it.

His members have the right:

- Request TSN for information about its activities.

- Participate in the activities of the association independently or by sending a proxy there (select and become a candidate for management positions, make proposals regarding improving the quality of work).

- If they do not agree with the decision of the governing bodies, they can appeal it in court.

- Familiarize yourself with the main documents of the organization.

- Demand from TSN the proper quality of services and work that they are obliged to carry out in accordance with the charter.

Registration procedure

IN charter union you need to specify it:

Members of TSN (and at the same time its founders) can be:

- Phys. persons who are owners of real estate designated as a public property.

- A legal entity that has the right to own, manage and manage the property of the partnership.

When joining an organization and filling out an application, the person who wishes to enter it provides information about himself. Later, this information will be entered into the register so that it can be established exactly what kind of real estate (share) belongs to this member. If there are any changes to the real estate or personal data have changed, the TSN participant will have to notify the board of the organization about this.

There are no strict and clearly defined requirements for the charter of a partnership in the legislation. The main thing is that its provisions do not violate the norms of the Housing and Civil Codes.

Advantages and disadvantages of such an association

Advantages associations of property owners as follows:

Flaws the associations are:

- It is not a universal organization with a legal status that will solve any problem. Much depends on the type of property itself. Not all owners should unite. For example, if the partnership consists of owners of unsafe housing or living in a building that requires major repairs, they are unlikely to be able to collect the required amount on time.

- There is a high risk of bankruptcy of the association. In this case, the owners will not be able to return their funds and contributions.

- TSN must obtain a license to conduct activities specified in the charter. This will take additional time, effort and money.

Distinctive features

Such an association of owners different from HOA the following features:

About the advantages of organizing this type of association of real estate owners, see the following video: