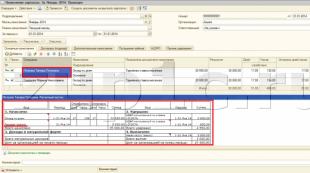

Will personal income tax be cancelled? Personal income tax of military personnel and reduction of the tax base. Stage: inversely proportional personal income tax scale

New presentation of personal income tax

Calendar of events of the target program of the NP NSRO "RUSLOM.COM" for the implementation of the legislative initiative to abolish personal income tax

April 20, 2015., Moscow, conference “Accounting, finance and law in the scrap market”, Metropol Hotel. Plenary industry meeting and open voting on the beginning of the implementation of the legislative initiative with the organization and coordination of the NP NSRO "RUSLOM.COM" to amend Art. 217 of the Civil Code regarding the abolition of personal income tax on the income of citizens, distributors of scrap and waste metals. The decision was made by a majority of delegate votes.

June 04, 2015. representatives of organizations in the metallurgical industry and the sphere of handling scrap and metal waste, members of the non-profit partnership “National self-regulatory organization of recyclers of scrap and waste of ferrous and non-ferrous metals, recycling of vehicles” and industry experts signed a collective letter of appeal to the Ministry of Finance of Russia on the issue of introducing changes in part exemption from personal income tax on income from the sale of scrap and recyclable materials.

July 7, 2015 A working meeting was held with the Russian Steel Non-Profit Partnership, at which members of the Partnership, which includes the largest metallurgical enterprises, unanimously supported the initiative to abolish personal income tax.

July 31, 2015 An official response was received from the Department of Tax and Customs Tariff Policy of the Ministry of Finance with explanations on the current situation in the field of legislative regulation on calculation, determination of the tax base, as well as the rights and obligations of taxpayers to pay personal income tax from the sale of scrap and recyclable materials. When making explanations, the Ministry of Finance was guided by the following provisions of the law:

- paragraph 1 of Article 210 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) on determining the tax base

- provisions 220 of the Code on tax and property deductions

- paragraph 17 of Article 217 of the Code regarding exemption from personal income tax on income from the sale of property

- Article 212 of the Code regarding the definition of income in the form of material benefits

- subparagraph 2 of paragraph 1 of Article 228 of the Code on the calculation and payment of tax by individuals

Some of the key problems, according to the Ministry of Finance, are:

- poor elaboration of the issue of tax administration

- problems in confirming expenses incurred for the acquisition of property

- problem in determining the period of ownership of property

- lack of a special procedure in determining the tax base for income from the sale of scrap and recyclable materials

- difficulties in the exercise by an individual of the right to receive a property tax deduction

- impossibility of establishing the period of stay of scrap and recyclable materials in the property of the taxpayer (in accordance with paragraph 17 of Article 217 of the Tax Code, income received by individuals who are tax residents of the Russian Federation for the corresponding tax period from the sale of property owned for three years or more are exempt from personal income tax)

September 23, 2015 An open working meeting was held in the Moscow Government Building (City Hall) on Novy Arbat on the implementation of the program of the NP NSRO "RUSLOM.COM" to improve the efficiency of legislative and tax regulation in the scrap processing industry, where the issue of abolishing personal income tax for individuals - scrap dealers was discussed in detail. Key market players, members of the initiative committee for the implementation of the program, representatives of government bodies (Government Office, Ministry of Finance), participants of public organizations (NP Russian Steel, Association of Waste Paper Recyclers, etc.) took part.

December 10, 2015 at the Renaissance Moscow Monarch Center NP NSRO "RUSLOM.COM" a conference was held on optimization of the legislative framework in the field of scrap and waste management. The issues of licensing, administrative and tax pressure on the industry, including the negative impact of personal income tax on relationships were considered enterprises in the industry with the financial and banking sector.

February 29-March 1, 2016 The 12th international forum “Scrap of ferrous and non-ferrous metals 2016” took place, where an extended plenary meeting was held on the issue of abolishing personal income tax on income from the delivery of recyclable materials by citizens. Interim results of the program and experience in implementing similar initiatives in related industries, as well as international experience in the field of tax legislation were presented.

March 3, 2016 A meeting at the Ministry of Industry and Trade with the participation of Deputy Minister S. Tsyb on improving the efficiency of the regulatory framework in the industry of handling scrap and metal waste. The main issue is the abolition of personal income tax.

March 31, 2016 The Government of the Russian Federation has given an opinion on the industry bill on the abolition of personal income tax on citizens’ income from the delivery of waste paper, initiated for submission by the SRO League of Waste Paper Recyclers. The summary notes that the exemption of citizens from personal income tax on income from the delivery of waste paper is advisable from the position of improving the administration of income through the recognition of persons paying income as tax agents with partial exemption from taxation of the corresponding income.

May 19, 2016. Participation of representatives of the NP NSRO "RUSLOM.COM" in an extended meeting of the Committee of the Russian Chamber of Commerce and Industry on environmental management and ecology. Consideration of the impact of the abolition of personal income tax on secondary raw materials on the development of the processing industry.

June 28, 2016. Together with the Chamber of Young Legislators and the League of Waste Paper Recyclers Conducting a round table in the Federation Council of the Federal Assembly of the Russian Federation on the optimization of legislation in the field of secondary resources, including on the abolition of personal income tax on income from the delivery of scrap and waste paper by citizens, the introduction of new OKVED and OKPD and mandatory self-regulation

August 17-22, 2016. The Government of the Russian Federation, the Ministry of Industry and Trade of the Russian Federation, the Ministry of Finance of the Russian Federation, the Ministry of Economic Development of the Russian Federation, the Ministry of Construction of the Russian Federation, the Ministry of Natural Resources of the Russian Federation were sent supplemented letters with a financial and economic justification for the abolition of personal income tax on citizens’ income from the delivery of recyclable materials in connection with preparations for the adoption of a new tax in the Russian Federation in 2017 environmental legislation (458-FZ)

September 02, 2016. A response was sent to the request of the Ministry of Industry and Trade addressed to NP NSRO "RUSLOM.COM" regarding the optimization of legislation in the field of control over the illegal trade in scrap in Russia, including a measure to abolish personal income tax. The issue was considered on September 9, 2016 during Dmitry Medvedev’s working trip to the Trans-Baikal Territory.

September 27, 2016 A working meeting was held between representatives of the NP NSRO RUSLOM.COM and NP Russian Steel on the optimization of the regulatory framework in the field of handling scrap and metal waste, as well as the fight against illegal trafficking of scrap.

September 29, 2016 Interdepartmental meeting with the participation of Deputy Minister of Industry and Trade of the Russian Federation S. Tsyb on improving the regulatory framework in the field of waste management, including the abolition of personal income tax on citizens’ income from the delivery of scrap and waste metals.

Information on the industry of handling scrap and waste metals.

Metal is used metal products, tools, equipment, machines or their metal parts, containers and packaging made of ferrous and non-ferrous metals (cast iron, steel, aluminum and tin), metalworking waste (shavings, sawdust, dust), scrap, metal production waste, metal cutting waste, used batteries, wires that have lost their consumer properties (steel, aluminum, copper).

Scrap metal is a strategic raw material for metallurgical production and is included in the list of the most important goods of the Russian Federation.

Recycling waste metals is much less expensive than smelting metals from ore. Energy consumption in the production of metals and metal products is significantly reduced (by 60-95%): Al - by 95%, Cu - by 83%, Steel - by 74%, Pb - by 64%, Zn - by 60%.

- when smelting steel from metal waste (compared to smelting from ore), the amount of air pollutants is reduced by 85%;

- When smelting Al, Cu and Pb from scrap (compared to smelting from ore), the amount of gas emissions is reduced by 5-10 times.

The largest amount of secondary ferrous metals is formed during their production - 45%, during depreciation of equipment (liquidation of fixed assets, repair and replacement of equipment, tools, inventory) - 33% and in the process of metalworking (20%). Among various industries, the largest amount of ferrous metal waste comes from transport engineering, shipbuilding, machine tool building, and instrument making. In Russia, about 30 million tons of scrap and ferrous metal waste are generated annually.

The largest amount of scrap and non-ferrous metal waste is generated at enterprises in the electrical, metallurgical, automotive and shipbuilding industries. In Russia, the share of secondary non-ferrous metals in the total balance of metal production is only 20-30%, in Europe - 35-50% (Al, Cu, Pb, Zn). The share of secondary metals generated in MSW in Russia is about 13%

In the Russian Federation, a significant part of metal waste (70-80%) is not recycled and is irretrievably lost. This is explained by the fact that a lot of waste ends up in MSW, is lost in the form of scrap cars, etc.

In the Russian Federation, according to the Ministry of Natural Resources, 60 million tons of solid household waste are generated annually - over 400 kg per person. No more than 8% is reused (versus 40% in the USA and 60% in the EU), the rest is buried

According to various studies of the morphological composition of MSW, the content of scrap and metals in MSW and equivalent waste from the non-residential sector averages more than 7%.

Thus, per person in the Russian Federation, about 28 kg of scrap metal is generated (7% of the total volume of municipal solid waste) or more than 4,100,00 tons per person in the Russian Federation (in 2016 - 146,544,710 people). According to experts, this volume is almost completely buried in landfills due to the lack of a separate waste collection system, and the presence of tax and administrative barriers that prevent citizens from being encouraged to recycle the metal generated in their private households.

At the same time, budget costs associated with the disposal of scrap metal as part of MSW amount to about 4,920,000 thousand rubles. per year (with an average cost of disposal of 1,200 rubles per ton, taking into account processing at waste transfer and transportation stations).

The tax burden, together with social charges, from the country's GDP, according to the Federal Tax Service of the Russian Federation, is 44%. The cumulative effect in the industry is 220.00 rubles per 1 kg of non-recycled metal lost in a landfill. That is, more than 902 million rubles. taxes lost to the budget per year.

In this regard, adjustments are required both to the legislative framework and to a number of strategic approaches to the development of the industry and the management of metal waste and scrap.

Including , The Ministry of Industry and Trade of Russia, the Ministry of Finance of Russia, the Ministry of Economic Development of Russia and other responsible ministries and departments support the introduction to the State Duma of the Russian Federation of a bill regarding amendments to Article 217 of Part Two of the Tax Code of the Russian Federation regarding the abolition of personal income tax on income received by individuals from the disposal of scrap and waste for recycling ferrous and non-ferrous metals. The presence of personal income tax on citizens' income from the delivery of recyclable materials impedes the effective implementation of the new environmental legislation, which comes into force on January 1, 2017, which provides for the separate collection of MSW and prohibits the disposal of useful fractions at landfills.

458-FZ comes into force on January 1, 2017 and provides for new mechanisms for the implementation of 89-FZ “On production and consumption waste”. According to 458-FZ, it is prohibited to send to landfills MSW, which contains useful fractions that are secondary raw materials for industry (metal, paper, plastic, glass, etc.) and can be recycled. Currently, in Russia and other countries of the world there are no other effective mechanisms for the separate collection of waste and the return of recyclable materials to economic circulation, except for the activities of citizens in collecting and sorting MSW. Personal income tax is a key demotivator. The abolition of personal income tax for citizens who deliver secondary raw materials will facilitate the implementation of this legislative measure and will help avoid the loss of metal in landfills and pollution of water and soil with toxic substances such as mercury. The relevance of this measure is confirmed by the fact that the head of the Ministry of Natural Resources, Sergei Donskoy, based on the results of reports on the readiness of the regions to implement 458-FZ, recognized 23 regions as completely unprepared, and the readiness of other entities as insufficient or minimal. The Law “On Industrial and Consumer Waste” obliges regional authorities to approve territorial waste management schemes by September 26, 2016 and submit them to Rosprirodnadzor for approval. However, without the involvement of citizens, regions will not be able to implement an effective system for introducing separate collections.

The benefit for exempting coupon income from bonds of Russian issuers from personal income tax becomes unlimited. Last week, the State Duma adopted relevant amendments to the Tax Code.

Personal income tax will not return

This removes the temporary restrictions within which coupons on bonds of Russian organizations denominated in rubles and issued after January 1, 2017 are exempt from personal income tax. Let us remind you that the preferential treatment now applies to securities issued from January 1, 2017 to December 31, 2020 inclusive.

On April 4, President Putin signed a law on the coupon of corporate bonds issued between 01/01/2017 and 31/12/2020. A coupon whose yield does not exceed the Bank of Russia rate + 5 percentage points is not subject to personal income tax. The current rate of the Central Bank of the Russian Federation is 8.5% + 5 percentage points = 13.5%. A coupon with a yield exceeding this figure is subject to tax.

As a result, the benefit is good, but it works very selectively. So, personal income tax is not paid on coupon income on a bond if it:

– issued by a Russian issuer;

– ruble;

– coupon yield = rate of the Central Bank of the Russian Federation + 5 p.p.

But despite these restrictions, the choice of suitable bonds on which you can save on taxes is a small thing, but nice. In addition, this type of bond is great for purchasing on, making it even more interesting.

“Physicists” are interested in bonds

Market participants are confident that the removal of time limits will be an additional incentive for individuals to enter the debt market. “This makes it possible to develop a borrowing strategy for a period after the 20th year, and investors, of course, give reasons to count on the consistency of tax policy in relation to stimulating investment demand,” says NAUFOR President Alexey Timofeev.

In “Professional Securities Market Participants” for the second quarter of 2017, the Bank of Russia notes that the largest volume (48.2%) of exchange transactions on the stock market for the third quarter in a row was accounted for by the corporate bond market (in the first quarter of 2017 – 32. 1%, in the fourth quarter of 2016 – 33.4%). “Such a rapid increase in the share of the corporate bond market in the total volume of transactions on the stock market is also due to the influx of private investors into the segment,” Central Bank experts report.

Dmitry Lesnov, head of the customer service department at FINAM JSC, agrees that this event has become an additional incentive for individuals: “The news that coupon income on bonds issued from 2017 to 2020 is not taxed was received very well.” positively, we can say that it became a trigger. The number of those wishing to buy bonds or at least learn more about them among our clients has increased by 30-40% compared to last year. Moreover, interest in the segment as a whole has grown, and not just in the securities issued in 2017.”

The main demand from individuals is observed in OFZs, the coupon income of which was initially not subject to personal income tax, and securities of corporate borrowers, and we are not only talking about securities issued in 2017. However, interest in the securities of corporate borrowers from the first echelon has also grown significantly. “Currently, the yield on 3-5 year securities of quasi-sovereign borrowers, such as VEB and Gazprom, is 8-9%. However, these are highly liquid securities, so the investor does not have to hold them throughout the entire circulation period. You can exit such securities at a convenient time with a minimum spread, receiving an income of 8% per annum for the period that the security was in your portfolio. At the same time, state banks offer deposit rates of 5-6%,” adds Dmitry Lesnov.

An additional incentive for private investors was the reduction in rates on bank deposits and the negative situation in the banking sector as a whole due to the reorganization of large banks. “When placing funds in bonds of reliable issuers, we can talk about a yield of 1-1.5 percentage points. per annum above the level of the Central Bank key rate,” noted Alexander Dubrov, head of the Internet trading department of Otkritie Broker.

The need to introduce a progressive taxation scale in Russia has been talked about for a long time - its differences from the flat system (when everyone, regardless of income, pays 13% personal income tax) is that the higher a citizen’s income, the higher the tax rate applied to him. This will ensure social justice, when the rich have to give a larger part of their income to the budget, compared to the poor. In the current Russian conditions, when the rate of decline in the incomes of most citizens exceeds a 15-year maximum, and every sixth citizen lives below the poverty line (about 16% according to Rosstat), this concept is becoming increasingly relevant.

Considering it as part of the discussion of the new pension savings system, the Central Bank, together with the Ministry of Finance, thought about the fate of pensions for low-income citizens. According to those developing the new “tandem” concept, it will be too difficult for Russian poor people to participate in the voluntary savings system due to the lack of extra money. To resolve this situation, the Central Bank announced the possibility of canceling part of the personal income tax for the poor, and it was proposed to use the saved funds for pension savings. Careerist.ru tried to figure out how real such initiatives are and what they imply.

Two possible concepts

For reference. According to Art. 7 of the Federal Law “On State Social Assistance”, a family or person whose average per capita income is below the minimum wage established in a specific subject of the federation can be recognized as low-income. The calculation of average per capita income is based on the income of all family members or a specific citizen received by him for 3 months. Thus, members of a family of 4 people (2 adults and 2 children) can be recognized as low-income, even if the income of adults exceeds the subsistence level, but does not provide it for family members with no income.

Deputy Chairman of the Central Bank Vladimir Chistyukhin announced the possibility of exempting low-income citizens from part of their personal income tax by transferring these funds to pension savings on October 20, at a meeting of the Public Chamber. In the absence of excess funds to participate in the voluntary funded pension system, this can become an effective tool for all those who today formally live below the poverty line. But, as Rossiyskaya Gazeta reports, this is not the only possible approach to solving problems with pensions for the poor - as an alternative, a rather cynical concept is being considered, according to which citizens with low incomes could be excluded from the future funded system altogether. The fact is that their contributions will be too small, and the administrative costs will be large, so eliminating them will save on system administration.

Citizens with low incomes may be excluded from the future funded system altogether.

Obviously, the second concept, excluding poor people from the new pension savings program, is a much higher priority for developers. But how “ethical” is even voicing such a proposal from the government, given that almost 16% of the population lives below the poverty line? It turns out, they propose to deprive 23 million citizens of the opportunity to save for retirement, hiding behind the high cost of managing these funds? Not entirely true, because the insurance pension, according to the new pension reform, will remain untouched - the funded part will only be an addition.

It turns out that just as you lived in poverty all your life, live in retirement...

But in this case, the new system is deprived of any principle of voluntariness, because if previously everyone was included in it without fail, then in the future, if tied to the subsistence level, the poor will be forcibly deprived of this right? This issue was not raised at the meeting. Moreover, many other aspects remain open: the legal basis of the pension structure, the possibility of using collective agreements, the responsibility of employers, etc. There is not much time left to resolve this entire range of issues: the Ministry of Finance and the Central Bank should present a ready-made concept in a month, and it should be operational in a year – by the beginning of 2018.

Eliminate income tax

This is not the first time that the proposal to remove income taxes from the poor, or at least reduce them, has been voiced.

Previously, subject to “difficult economic conditions,” it was proposed in the Federation Council to exempt from paying personal income tax citizens whose income is below the minimum wage (and, accordingly, below the subsistence level). As RIA Novosti reported, the initiative was expressed by Altai senator Vladimir Poletaev. In his opinion, initially the income tax for the poor would need to be reduced to 3%, and subsequently completely eliminated, replacing it with a progressive system of taxation of wealthy citizens. According to the parliamentarian, this would draw the attention of local authorities to the problem of “gray” salaries, since income tax is the main source of replenishment of local budgets.

Later, Vladimir Slepak, a member of the Public Chamber of the Russian Federation, made a similar proposal. As TASS reported, the public organization even sent a corresponding letter to Deputy Prime Minister Olga Golodets. In it, social activists focus on the constant “dedicated” search for funds to solve the problems of the poor, instead of which they propose to completely exempt this category of citizens from taxes by introducing a progressive taxation system. Such a system, according to Slepak, would support those in need and reduce dependency attitudes. Moreover, it is extremely difficult to explain to citizens how they can live on their average per capita income if it is below the subsistence level, and in addition to raising and educating their children, they also need to pay income tax.

However, today social activists no longer hope that the Central Bank and the Ministry of Finance will decide to partially deprive the poor of the obligation to pay personal income tax. As Elena Topoleva-Soldunova, a member of the RF OP, said in an interview with Rambler News Service, the departments will take into account the economic situation in the country and will not allow the poor not to pay taxes, although it is time to change the taxation system to a progressive one. But at the same time, according to deputy Anatoly Aksakov, it will be very difficult to motivate Russians to enter the voluntary pension savings system, especially since most of them have very low incomes. A lowering the personal income tax rate would be just such an incentive.

And the issue of incentives, indeed, remains the most pressing. After all, if the new pension system is voluntary, then which of the poor will participate in it?

The poor cannot or will not

If we consider the first concept proposed by the Central Bank, which provides for the exemption of the poor from personal income tax, it would still be a mistake to call it “exemption”. If this is really only presented as an opportunity to transfer it to the voluntary pension system, then people with small incomes will certainly thank you for such a tax break, but they definitely won’t contribute their hard-earned money to the pension system. As Yuri Gorlin from RANEPA says, whose words are quoted by FBA Economics Today, the poor might be happy to save for retirement, but an income of 10-15 thousand rubles does not allow this. In addition, the ratio of the insurance pension to their income exceeds 50%, which makes it possible to avoid a catastrophic loss of income after stopping work.

So the only possible and adequate option is to exempt from personal income tax that part of the income that will be transferred as pension savings (remember, they will range from 0 to 6% of earnings). Of course, it would be nice to make concessions to the poor and exempt them from paying that part of the income tax that remains after contributions to the NPF, but the Central Bank and the Ministry of Finance clearly will not agree to this - today every penny counts. So, most likely, the funds remaining after deductions - from 7 to 13% of income - will actually act as income tax.

An adequate option is to exempt from personal income tax that part of the income that will be transferred as pension savings.

In this case, there is no need to talk about any tax breaks for the poor - Such citizens will not be able to receive additional income “on hand”. And the savings themselves will not be pleased with their special size - if we proceed from the current average subsistence level of 10.7 thousand rubles (in many regions it is significantly less), then the volume of annual savings will be clearly less than 7.7 thousand rubles(given that their income should be below the subsistence level). Nevertheless, the incentive itself still exists - low-income citizens will have a choice: either give their personal income tax in full to the state, or receive part of it as pension savings.

The choice, in this case, is obvious. Of course, it would be nice if the initiators of the new pension reform made an exception and allowed the poor to transfer the entire tax into savings, but one should not hope for this. However, it is worth remembering that the concept of personal income tax is not the only one considered by the Central Bank and the Ministry of Finance, and the decisions they make are not always considered from an ethical point of view.

Good afternoon, dear colleagues.

We continue to consider proposals for changes to the legislation on taxes and fees. And the next tax, which also kills any desire to work, is the personal income tax. Thank God, it’s still small here, the rate is 13%, the scale is flat. In remarkable and “particularly developed” countries, as a rule, a progressive scale has been introduced for the income of individuals. And this generally kills any desire to work, because the more you earn, the higher the tax rate, and this does not encourage a person to earn a lot.

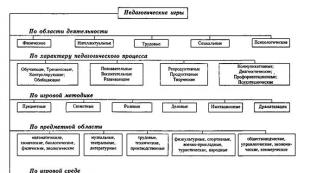

Stage 1: inversely proportional personal income tax scale

I propose to deal with personal income tax in two stages.

First stage: introduce an inversely proportional scale for the payment of personal income tax. What does "inversely proportional scale" mean?

You can, of course, calculate everything so that the budget does not lose anything. And here, please, do not find fault with the numbers. You can take a calculator, take the legal wage fund, which enterprises now pay legally. The tax authorities have absolutely all the data. This is all easy to calculate, I just don’t have them, because... I'm not the Federal Tax Service. For taxpayers, this data is still classified; only from the summer of 2017, the Federal Tax Service website will have information about how much taxes each taxpayer has paid and how many people work for him. Then I will be able to do this analysis, and not on a Russian scale, but only on the example of individual enterprises, based on Federal Tax Service data.

So, colleagues. What is my idea? Don’t pick on the numbers, just consider them as an idea. For example, a person receives a legal salary of 200 thousand rubles. per month, he pays personal income tax 2%. If his salary is 150 thousand rubles. per month, then he pays 5% personal income tax. And if his salary is 100 thousand rubles. per month, personal income tax will be 10%. If his salary is 70 thousand, he pays 12% personal income tax. If 50 thousand rubles. per month - he pays personal income tax 15%, and if 30 thousand rubles. per month, he pays 20% personal income tax. This is roughly the scale you need to make.

You say: “3/4 of the employed citizens will now begin to scream furiously. Like, how can it be, on the contrary, we need to take money from the rich. On the contrary, we need to take money from those who earn a lot. I already earn my 20 thousand, but you want to take 20% from 20 thousand. And from a rich person who earns 200 thousand, you propose to take only 2%?”

Yes, that's exactly what I'm suggesting. This is what I am proceeding from, colleagues. This will automatically force you to get your employer (and he himself will do this) to legalize your wages. Because at this moment in micro-businesses, small and medium-sized businesses, approximately 30%-70% of your salary is paid to you in an envelope. And if we implement... In the next article I will write about insurance premiums, there will be separate proposals there.

And, if we implement this rule of an inversely proportional scale for personal income tax, it will be beneficial for you to legalize your wages. So that according to the statement it is as large as possible in order to reduce the personal income tax rate.

Every citizen of the Russian Federation will have an incentive to improve their professionalism

In this way we will reward those who do good work. After all, as a rule, if we are talking about business, in business they don’t pay salaries, you understand? It is the officials who pay salaries. Regardless of whether the official worked well or poorly, he will still receive his pay. In business, as a rule, you pay for results. Accordingly, if a person has a high salary, this means that he works well and occupies a good position. Accordingly, every citizen of the Russian Federation will have an incentive to improve their professionalism with a pitchfork at their neck, constantly learn and achieve new and new heights. And this will have a beneficial effect on the entire economy.

I am ready to write about 200 specific proposals on what needs to be done in the field of taxes and the economy in order to make this economy work, so that the bureaucracy is reduced...

Stage 2: gradual abolition of personal income tax

The next thing is about personal income tax. When we have worked like this for some time, at the second stage we can start the process of gradually completely abolishing this tax altogether. By this point, if all the proposals that I give are implemented as a whole, the revenue side of the budget will grow sharply. Businessmen, without using any methods, will happily legalize all their businesses themselves and will happily pay taxes to the budget. And after that, you can completely get away from personal income tax, because in general the idea of an income tax itself kills a citizen’s business initiative. There should be no income tax at all.

Of course, somewhere in between it is possible to develop a program that will facilitate the system for calculating personal income tax and simplify it as much as possible. What I mean? Let's take another concrete example. Today, if you buy an apartment and it costs 6 million rubles, of which 3 million rubles is the “body” of the loan, i.e. you paid part of the money from your own, and took part of the money from the bank, and another 3 million is interest on the loan. And today, as soon as your salary reaches 2 million rubles, and by this moment you have paid 13% to the state from these two million rubles Article 220 of the Tax Code of the Russian Federation, the state allows you to return this personal income tax of 13% from 2 million rubles. Make a so-called deduction.

That is, the state will return 260 thousand of the personal income tax already paid to you. Well, plus, colleagues, let’s say you’ve worked for several years and your salary has accumulated. You can do this as you pay interest to the bank, be that as it may, from the total amount of 3 million rubles of additional wages, the state will return another 13% of personal income tax to you, that is, 390 thousand rubles in terms of helping you pay off bank interest.

And that's it - a limit has been set. I propose to remove all these limits altogether. What are they needed for? Let people get rich. Let them buy up this property. There are a huge number of exceptions to the rules for personal income tax. Open Article 217 of the Tax Code of the Russian Federation- there are complete exceptions. In fact, it was possible Chapter 23 of the Tax Code of the Russian Federation, by removing all the unreasonable exceptions, removing all these confusing, meaningless rules, this chapter in volume can be reduced by 5 times. And the order would also be 5 times greater.

Be that as it may, in my opinion, it is necessary to encourage abilities, productivity, and encourage wage growth, including through reducing tax rates. And vice versa, punish those who work poorly or, conversely, do not want to work. Soon we will reach completely revolutionary proposals. You need to act gradually, step by step. But nevertheless, a number of these proposals need to be implemented comprehensively.

The population of Russia annually pays about 2.5 trillion rubles on the country's debts.

Do I believe that modern politicians will implement any of this? No I do not believe. There are other goals and objectives. There is no goal to simplify, there is no goal to remove the corruption component. There is a goal there, building up an army of officials and ripping off 3 skins from businessmen, increasing the national debt...

According to Mr. Siluanov, last year about 650 billion rubles were spent, this year 700 billion rubles. only government debt. It is cheap compared to total debts. What is 700 billion rubles? According to Ms. Skvortsova (figures from the Ministry of Health website), the federal level healthcare budget for 2017 is 380 billion rubles, the regional healthcare budget is about 900 billion rubles.

If we take the federal budget allocated for health care is 380 billion rubles, then in terms of servicing the public debt, we spend 700 billion rubles. – 2 budgets. According to Siluanov, the state budget is now borrowing at a rate of 10%-11% per annum. This is not some kind of fiction, not some kind of gossip, based solely on official data.

The state-owned company Gazprom also borrows money from the market. Rosneft borrows money. This means that you all pay off the debts of both Gazprom and Rosneft, because all this immediately goes into the cost of fuel. I have written a separate large analytical article on this subject, with numbers and facts - no opinions. When I counted all the debts, annually, according to the most conservative estimates, it was not as Siluanov said - 11% per annum for federal borrowing, but I even took 5.5%, the Russian population annually pays back about 2.5 trillion in debt. My dears, this is the budget for healthcare, education, housing and communal services and... everything combined. And we spend it only on debt repayment.

I am for you to get rich and prosper

I’m talking about the fact that you can safely, gradually, at some step or stage, remove personal income tax. Not only does it stimulate the economy, it’s still pennies compared to the debt hole into which we have driven ourselves. Not to mention the fact that this will stimulate economic development. We need to encourage people to get rich and earn a lot. It needs to be stimulated not by calls on TV, although calls are also needed. But, by the way, they are not on TV. On the contrary, it all comes down to...

I listened to the recorded radio broadcast with Potapenko, there were corresponding calls. The callers accused businessmen of making money. Well, what nonsense, my dears? Well, earn money too. I personally want you to get rich and prosper. I want to create the appropriate conditions for this. I ask you very much: no matter what articles you read, do not consider them political statements. This area of life (politics) does not interest me at all. The current government has discouraged anyone from engaging in politics not according to their rules. Therefore, I am not going to engage in politics according to their rules, and we have no other rules. So, all these things that I’m talking about are aimed solely at ensuring that our politicians have more money in their pockets... After all, the larger the budget revenue, thanks to my proposals, the more opportunities they will have (how to put it carefully ) through tenders in which one single company participates, transfer this budget money to this single company.

Thank you, dear colleagues.

All funds that are in the hands of citizens of the Russian Federation must be subject to taxes. Conducting work, selling real estate, receiving expensive gifts, etc. - from all this income, Russians are required to contribute 13% to the state treasury. This fee is called “Personal Income Tax” and is mandatory for everyone. Violations, underpayments and any fraud in settlements and payments are prosecuted by law. Military personnel and employees of law enforcement agencies of the Russian Federation are not exempt from personal income tax, but can receive significant relaxations when calculating this fee.

Types of deductions provided

Personal income tax for military personnel is calculated in a general manner using standard types of tax base reduction that are available to the rest of the population. The main purpose of the deduction is to reduce the total amount of income on which the notorious 13% is charged.

Let's take a closer look at the tax base reductions available to military personnel:

- For children. If an army man is the father, he is entitled to a deduction of 1,400 rubles for the first and second child, 3,000 rubles for the third and subsequent ones. This relaxation applies to all citizens of the Russian Federation until the total military income exceeds the amount of 350,000 rubles.

- Standard in the amount of 3000 rubles. A significant reduction in the amount of income for each month of the tax period is provided to citizens listed in Article 218 of the Tax Code of the Russian Federation. If a person liable for military service belongs to one of these categories, he can count on receiving this deduction.

- Standard in the amount of 500 rubles. Provided for veterans of combat operations in Afghanistan and other hot spots.

- Social. A serviceman can significantly reduce the overall tax base if, during the reporting period, he taught children, or he or one of his family members was sick and treated. The amount of tax deduction for training or treatment is provided in the amount of actual expenses incurred, but not more than 50,000 rubles.

- Property. If a soldier purchased real estate during the year, he has the right to receive a property deduction. Refunds will be made in the amount of 13% of the value of the property purchased or sold. The main condition is to buy an apartment or house with your own funds, not budget funds.

Cancellation of personal income tax for military personnel

Previously, all amounts of military allowance, various remunerations, bonuses and other additional payments received by military personnel for the performance of their direct duties, without exception, were not subject to taxation. The entry into force of the current Tax Code in 2001 changed the existing order and transferred the military to the standard calculation of personal income tax, leaving only a few items of income tax-free:

- compensation payments upon dismissal from the ranks of the RF Armed Forces;

- compensation for the cost of vouchers provided to children under 16 years of age;

- material assistance to current and former Aryans in an amount not exceeding 4,000 rubles;

- amounts of compensation for part of parental fees for preschool and developmental institutions.

Tell us about your experience of calculating personal income tax and receiving compensation payments for it, share the practice of an experienced taxpayer in the comments of our blog.