Transport tax rates for organizations per year. How to pay transport tax for legal entities. Which organizations pay transport tax?

The procedure, rates and deadlines for paying transport tax in Moscow for 2019-2018 were approved by Moscow Law No. 33 dated 07/09/2008 “On Transport Tax” (with appropriate amendments and additions in force in 2019).

Procedure and deadlines for paying transport tax in Moscow

The tax for each vehicle is paid in full rubles (50 kopecks and more are rounded up to the whole ruble, and less than 50 kopecks are not taken into account) to the budget of the city of Moscow.

Taxpayer organizations pay tax no later than February 5 of the year following the expired tax period. During the tax period, advance tax payments are not made by taxpayer organizations.

Thus, organizations need to pay transport tax for 2018 by February 5, 2019, for 2019 by February 5, 2020, and for 2020 by February 5, 2021. More details about procedure for tax payment by legal entities read the article at the link.

The deadline for payment of transport tax for 2018 for legal entities in Moscow is February 5, 2019

Citizens pay transport tax on a car on the basis of a tax notice sent by the tax authority. The amount of tax on a car is determined by the tax authorities on the basis of information submitted to the tax authorities by the authorities carrying out state registration of vehicles on the territory of the Russian Federation. Individuals must pay transport tax in the general manner no later than December 1 of the year following the expired tax period, that is, in 2019, the tax is paid for 2018, respectively, at the rates established for 2018, and the car tax for 2019 - until December 01, 2020.

Tax payment deadline for citizens: Since 2016, the deadline for payment of transport tax on a car for individuals has changed - now the tax must be paid before December 1 (previously, the payment deadline was set until October 1).

Transport tax is payable no later than December 1 of the year following the expired tax period. That is, the car tax for 2017 must be paid before December 1, 2018, for 2018 - before December 1, 2019., and for 2019 - until December 1, 2020. If December 1 is a non-working day, the payment deadline is postponed to the next working day.

The deadline for paying transport tax on a car in Moscow in 2019 is until December 2, 2019 (the tax is paid for 2018)

Transport tax rates in Moscow

Automobile tax rates in Moscow are set accordingly depending on engine power, jet engine thrust or gross tonnage of vehicles per one vehicle engine horsepower, one kilogram of jet engine thrust, one register ton of vehicle or unit of vehicle in the following sizes:

| Name of taxable object |

Tax rate (in rubles) for 2017-2018, 2019 |

|

Passenger cars |

|

|

over 100 hp up to 125 hp (over 73.55 kW to 91.94 kW) inclusive |

|

|

over 125 hp up to 150 hp (over 91.94 kW to 110.33 kW) inclusive |

|

|

over 150 hp up to 175 hp (over 110.33 kW to 128.7 kW) inclusive |

|

|

over 175 hp up to 200 hp (over 128.7 kW to 147.1 kW) inclusive |

|

|

over 200 hp up to 225 hp (over 147.1 kW to 165.5 kW) inclusive |

|

|

over 225 hp up to 250 hp (over 165.5 kW to 183.9 kW) inclusive |

|

|

Motorcycles and scooters with engine power (with each horsepower) |

|

|

up to 20 hp (up to 14.7 kW) inclusive |

|

|

over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive |

|

|

over 35 hp (over 25.74 kW) |

|

|

Buses with engine power(per horsepower): |

|

|

up to 110 hp (up to 80.9 kW) inclusive |

|

|

over 110 hp up to 200 hp (over 80.9 kW to 147.1 kW) inclusive |

|

|

over 200 hp (over 147.1 kW) |

|

|

Trucks with engine power (per horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive |

|

|

over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive |

|

|

over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive |

|

|

over 250 hp (over 183.9 kW) |

|

|

Other self-propelled vehicles, pneumatic and tracked machines and mechanisms (per horsepower) |

|

|

Snowmobiles, motor sleigh with engine power (per horsepower) |

|

|

up to 50 hp (up to 36.77 kW) inclusive |

|

|

over 50 hp (over 36.77 kW) |

|

|

Boats, motor boats and other watercraft with engine power (per horsepower) |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

Yachts and other motor-sailing vessels with engine power (per horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp (over 73.55 kW) |

|

|

Jet skis with engine power (per horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp (over 73.55 kW) |

|

|

Non-self-propelled (towed) vessels, for which gross tonnage is determined (from each registered ton of gross tonnage) |

|

|

Airplanes, helicopters and other aircraft with engines (per horsepower) |

|

|

Airplanes with jet engines(per kilogram of traction force) |

|

|

Other water and air vehicles without engines (per vehicle unit) |

Note,when collecting car tax apply increased transport tax coefficients for expensive cars worth more than three million rubles.

Attention:Due to the fact that the final tax amount depends on the category and make of the car, its power, we do not recommend using online calculators. The most accurate calculation is achieved by simply multiplying the car's power by the tax rate (taking into account increasing factors for expensive cars).

Benefits for paying transport tax in Moscow

The Moscow Law “On Transport Tax” completely exempts from paying tax:

- organizations providing services for the transportation of passengers by public urban passenger transport - for vehicles carrying passengers (except taxis);

- residents of special economic zones of technology-innovation type created on the territory of the city of Moscow (hereinafter referred to as special economic zones) - in relation to vehicles registered in the name of these residents, from the moment of inclusion in the register of residents of the special economic zone. The benefit is provided for a period of 10 years, starting from the month of registration of the vehicle. The right to the benefit is confirmed by an extract from the register of residents of the special economic zone, issued by the management body of the special economic zone;

- 2.1. organizations recognized as management companies of special economic zones and carrying out activities for the purpose of implementing agreements on the management of special economic zones - in relation to vehicles registered in the name of these organizations, from the moment of conclusion of agreements on the management of special economic zones with the federal executive body authorized by the Government of the Russian Federation . The benefit is provided for a period of 10 years, starting from the month of registration of the vehicle - the benefit was introduced in 2018;

- 2.2. management companies of the international medical cluster and project participants who have entered into agreements on the implementation of the project with the management company of the international medical cluster and carry out project implementation activities on the territory of the international medical cluster - in relation to vehicles registered to the management companies of the international medical cluster and project participants. Project participants are provided with a benefit from the moment of concluding an agreement on the implementation of the project with the management company of the international medical cluster - the benefit applies from 2018 to 2028;

- Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees,

- veterans of the Great Patriotic War, disabled people of the Great Patriotic War - for one vehicle registered to citizens of the specified categories;

- combat veterans, disabled combatants - for one vehicle registered to citizens of the specified categories;

- disabled people of groups I and II- for one vehicle registered to citizens of the specified categories;

- former minors concentration camp prisoners, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War - for one vehicle registered to citizens of the specified categories;

- one of the parents (adoptive parents), guardian, trustee of a disabled child - for one vehicle registered to citizens of the specified categories;

- persons who own passenger cars with an engine power of up to 70 horsepower (up to 51.49 kW) inclusive - for one vehicle of the specified category registered to these persons;

- one of the parents (adoptive parents) in a large family- for one vehicle registered to citizens of the specified categories;

- Chernobyl victims - for one vehicle;

- individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities - for one vehicle registered to citizens of these categories;

- individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology - for one vehicle registered to citizens of these categories;

- one of the guardians of a disabled person since childhood, recognized by the court as incompetent - for one vehicle registered to citizens of the specified category.

Old-age pensioners do not have transport tax benefits in Moscow.

Important. The benefits listed in subparagraphs 3-8, 11-14 do not apply to passenger cars with engine power over 200 hp. (over 147.1 kW).

Benefits are provided to individuals upon application based on a document confirming the right to the benefit. If a taxpayer has the right to receive benefits on several grounds, the benefit is provided on one basis at the taxpayer’s choice.

Benefits do not apply to water, air vehicles, snowmobiles and motor sleighs.

If the right to benefits arises (loss) during the tax period, the tax amount is calculated taking into account a coefficient defined as the ratio of the number of complete months preceding the month (following the month) of the emergence (loss) of the right to benefits to the number of calendar months in the tax period. In this case, the coefficient is calculated to three decimal places.

Prepared by "Personal Prava.ru"

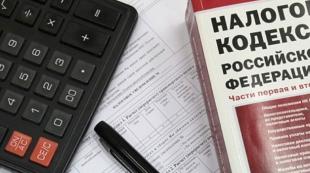

One of the direct taxes in our country is: it is paid by vehicle owners. The amount of tax depends on the brand, power, type of transport, and year of its manufacture. The economic effect obtained from the operation of equipment is not taken into account when calculating the tax.

For example, a car may sit idle in a garage for years and not bring any benefit to its owner, but the owner of the car is not exempt from tax. And for this reason, in particular, the transport tax has a lot of opponents and critics. The legislator is looking for a worthy replacement, but so far no such alternative has been found, so the tax will have to be paid for 2017. Advance payments are just being made now.

The tax is required to be paid by both individuals and legal entities. The difference between these groups of taxpayers:

- a citizen (), who owns registered equipment, receives a notification from the tax authorities with the calculated amount and pays the tax no later than the established deadline (for 2016 - no later than December 1, 2017). After this, his obligations to the state budget are considered fulfilled;

- legal entities independently calculate tax amounts, make advance payments and fill out a declaration. All responsibility for the correctness and timeliness of tax calculation rests with the taxpayer.

Transport tax for organizations 2017

Chapter 28 of the Tax Code is devoted to transport tax, which defines the categories of taxpayers - these are those persons who own officially registered vehicles. According to the law, all means of transportation are divided into groups:

- passenger cars;

- trucks;

- scooters, motorcycles;

- passenger and specialized buses;

- self-propelled mechanisms with pneumatic motion;

- tracked self-propelled vehicles;

- airplanes, helicopters and other aircraft;

- vehicles for driving on snow (motor sleds, snowmobiles);

- motor ships, sailing vessels, yachts, motor boats, boats, jet skis and other watercraft.

All organizations that have any of the listed vehicles on their balance sheets become payers of transport tax. For legal entities, the tax period does not coincide with the reporting period. According to Article 360 of the Code, the tax period for payers of all categories is the calendar year: from January 1 to December 31 inclusive. The following are recognized as reporting periods:

- first quarter (from January 1 to March 31);

- second quarter (from April 1 to June 30);

- third quarter (from July 1 to September 30).

At the end of the calendar year, the taxpayer fills out and submits a tax return in the approved form.

Only owners, that is, those organizations that have transport on their balance sheet, report on transport tax. The law does not require submitting blank declaration forms, so-called “zeros”. There is an explanation about this in the letter of the Ministry of Finance numbered 03-05-04-02\14 (dated March 4, 2008).

If the car is leased, then the lessor pays the tax, although the lessee uses it and makes a profit from its operation. The same picture applies to leased equipment. Until official ownership documents are issued for the vehicle, the lessor will pay the tax.

When to pay transport tax to legal entities 2017

The law on transport tax is federal, but it enshrines the transfer of powers to the subjects of the Federation in many respects. Thus, it is the regions that determine whether taxpayers must pay taxes in advance during the year. Therefore, the organization’s accounting service should contact the tax authorities at the place of registration and clarify information on advance payments.

For example, in the Saratov region, local legislation stipulates that advance payments are mandatory. Taxpayers - legal entities independently calculate the annual amount of transport tax, and then transfer one fourth of it to the budget within the following terms:

- for the first quarter - no later than April 25;

- for the second quarter - no later than July 25;

- for the third quarter - no later than October 25.

When making advance payments, it is necessary to correctly indicate the 2017 KBK transport tax for legal entities in the documents, since an incorrectly written budget classification code in the payment document can lead to the payment amount going to the wrong address and the tax will not be considered paid:

- BCC of the main payment 182 1 06 04011 02 10 00 110;

- KBK penalty 182 1 06 04011 02 21 00 110;

- KBC fine 182 1 06 04011 02 30 00 110.

The codes differ by only two digits, but there is no mistake in writing them.

Thus, the deadlines for payment of transport tax for legal entities in 2017 are established by regional legislation. If a local law on this tax has not been adopted in some region, republic or region, then taxpayers use the provisions of the federal law.

Payment of transport tax by legal entities in 2017 is also made in the form of advance payments for the current year on a quarterly basis, indicating the 2017 transport tax for organizations in the KBK payment documents.

Transport tax for legal entities 2017: rates

The Tax Code determines the basic tax rates for all types of transport. For cars, the tax base is determined by multiplying the horsepower of the vehicle by the tax rate. Table 1 shows the rates for passenger cars offered by the Tax Code.

Table 1. Tax rates for passenger cars

But each region must adopt its own legislation and approve its own rates for all types of equipment. There is a limitation: you can reduce or increase bets in any direction, but no more than ten times. You should find out about the rates at local tax offices or in a special service on the Federal Tax Service website.

Usually, when registering a new organization with the tax office, the latter's employees provide a list of local mandatory taxes. Thus, the 2017 transport tax for legal entities in the Tambov region for passenger cars is paid at the following rates (rubles per horsepower)

Example 1. Calculation of transport tax 2017 for legal entities registered in the Tambov region. The company LLC "Planeta" has three cars on its balance sheet:

- Power 160 horsepower.

- The power of the second was 140 horsepower.

- The third with a capacity of 210 horsepower.

Tax calculation for the year: 160*50+140*30+210*75 = 8,000 + 4,200 + 15,750 = 27,950 (rubles).

During the year, LLC "Planeta" must pay advance payments: 27,950: 4 = 6,987.50 rubles within the following periods: until April 30, until July 31, until October 31 of the current year. The organization must pay the final tax payment by March 1 of the following year.

Only organizations whose vehicles are registered in the Tambov region can use these rates and payment terms. Payment of transport tax by legal entities in 2017 in other regions may differ from the example given.

Tax return for transport tax

Having made advance payments to the budget during the year, organizations at the end of the tax period (calendar year) are required to fill out and submit a tax return for transport tax, and then pay the balance of the tax. Why in this sequence: first the declaration, then the payment?

The fact is that during the year, changes in the composition of the equipment may occur in the organization: something was written off or sold, something was bought or received as a contribution to the authorized capital. When preparing the annual tax return for transport tax, all these changes are taken into account and the final settlement with the budget is made.

Example 2. CJSC Vostok, located in the Tambov region, had 5 passenger cars on its balance sheet as of January 1, 2016: 140 hp, 120 hp, 210 hp. and two cars with 102 hp each. On March 1, 2016, one car with a capacity of 102 horsepower was written off due to complete wear and tear. On March 10th, the company bought 2 units of equipment with 210 horsepower each. Tax calculation:

- 140 * 30 = 4 200

- 120 * 30 = 3 600

- 210 * 75 = 15 750

- 102 * 30 = 3060

- 102 * 30 = 3060:12 = 255 * 3 = 765

- 210*75 = 15750:12=1312.50*10=13125 *2 = 26250 (for 2 cars)

Total: 4,200+3600+15750+3060+765+26250 = 53625 rubles. The 2017 transport tax advance for legal entities will be 53625:4 = 13406.25 rubles.

Explanations for the fifth and sixth points: if the vehicle was not on the balance sheet for a full calendar year, then the annual tax amount is divided by 12 months and multiplied by the number of months the vehicle was on the property. In this case, the month in which the car was written off is taken as full. The month of receipt of the vehicle is also taken as full, regardless of the date of its receipt.

Every year some changes are made to the transport tax return forms, so the document must be filled out according to the form and monitored for changes. Thus, the declaration for 2017 was amended by order of the Federal Tax Service dated December 5, 2016 (No. ММВ-7-21\668@) in connection with the implementation of the Platon system.

Like any tax return, a transport tax report can be submitted during a personal visit to the tax office or you can submit the document via the Internet in electronic form. There is another way - send by postal parcel. In the first case, you must have an identity card with you; in the second, a confirmed electronic signature is required. When sending by mail, an inventory of the attachment is required. An inventory is drawn up in two copies: one is included in the parcel post, and the second remains with the sender.

The most time-consuming, but also the most reliable way to submit a declaration is a personal visit to the tax office: if errors are found, they can be promptly corrected, the report must be urgently redone and submitted again. With the electronic method, and especially with the postal method, the time for correcting errors is extended. This way you can skip all the deadlines for submitting your declaration. Therefore, with these methods of sending (electronic and postal), the tax return should be submitted in advance in order to have enough time for possible rework of the document and corrections.

Where to pay transport tax for legal entities 2017

Advance payments, as well as the final payment for transport tax, are paid by organizations at the place of registration. Payment deadlines are determined by the local law on transport tax for organizations in 2017. Violation of tax payment deadlines or late submission of a tax return to the regulatory authority entails penalties.

If the transport tax is not paid on time, the regulatory authorities have the right to charge the defaulter a penalty in the amount of 1/300 of the refinancing rate of the Central Bank of Russia for each day of delay. For large enterprises with an extensive vehicle fleet, the amounts can be impressive.

Penalties are paid indicating a special budget classification code. In case of failure to report taxes and fail to pay transport tax, the company may be subject to a fine of at least 20 percent of the amount of unpaid tax.

Owning a certain type of property in our country implies the need to pay property tax. Its calculation is carried out within the framework of special legislation - the formula is determined

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Tax Code of the Russian Federation. At the same time, it is important to note that legal entities must carry out calculations and payments independently - there are other nuances associated with this subject of law.

Changes in 2019

Today, owning some types of property involves paying taxes. This is not only real estate, but also cars.

According to the law, it is necessary to pay property tax on vehicles. Its size is set individually, but according to standard standards.

The amount of transport tax is influenced by the following:

- car engine power;

- coefficient established by law for all cars;

- additional coefficients.

Moreover, it is worth noting that within the constituent entities, special legislative documents can be drawn up that allow tax collection coefficients to be changed up or down.

But there are some restrictions. Such independently determined values cannot differ by 10 times or more from the standard ones established by the Tax Code of the Russian Federation.

It is important to note some differences in calculations for different categories of owners:

- individuals;

- legal entities.

Usually there are simply no difficulties for individuals. Since the calculation is carried out by the tax service.

Moreover, this payment must be made in a one-time payment, over a fairly wide time period. Things are different for legal entities.

They will need to calculate their own transport tax. Moreover, payment must be made in advance. Usually 4 times a year.

For example, if you own a car, the transport tax on which is 36 thousand rubles, then during the tax period you will need to make 4 transfers of 9 thousand rubles each.

Moreover, late payment or underpayment threatens with serious troubles:

- imposing certain penalties for late payments;

- accrual of penalties for each day of delay.

In addition, there are many different additional points regarding calculations. This also applies to certain tax charges. Tax legislation is constantly changing.

Representatives of legal entities need to pay particular attention to this. Since they need to carry out the calculations themselves.

Moreover, legislation is changing not only at the federal level, but also in the regions themselves. Today, they have the right to independently implement a number of measures to formulate legislation.

There are some changes taking place in 2019.

There are a number of points that will need to be dealt with. These include:

- the coefficient has undergone certain clarifications since the beginning of 2019 - at the moment it is defined as the ratio of the total number of months of ownership to the number of months in the corresponding reporting period (from 2019, only the one in which the car was purchased on the 15th or later is considered a full month, based on the .3);

- the rule regarding expensive cars applies only to those that were presented on the official website of the Ministry of Industry and Trade as of March 1 of the reporting year (Clause 2 of Article No. 362 of the Tax Code of the Russian Federation).

There is an innovation in the transport tax on heavy goods vehicles - it is possible to receive a deduction for damage paid for by a legal entity. The question is determined by clause 2 of Art. No. 362 Tax Code of the Russian Federation.

Thanks to this deduction, it is possible to reduce the tax levy to literally zero.

The indicated innovations are determined precisely at the federation level. In this case, there may also be changes at the level of subjects.

If the head of a legal entity has any questions about this, he should contact the regional branch of the Federal Tax Service to resolve them.

Transport tax in 2019 for legal entities in Moscow is paid in accordance with the standard provisions of the Tax Code of the Russian Federation.

It is important to note that certain categories receive certain benefits. For example, this concerns the taxation of individual entrepreneurs.

But it is worth noting that standards similar to legal entities are usually applied to individual entrepreneurs. It is important to keep records of all expenses and generate reports.

It is also important to note that in 2019 the declaration for reporting has undergone some changes. In addition to such items as engine horsepower, new items are provided.

For example, No. 130 - implies information for heavy trucks using the Platon system. It is important to note that there are no tax benefits in 2019 for those using the simplified tax system (simplified taxation system).

If a legal entity or individual believes that their rights have been violated in any way, then it is worth going to court. The decision of this body will protect the rights of the taxpayer if there really is an error in calculating the tax fee.

Deadlines for payment of transport tax for legal entities

An important point is precisely the moment of payment of the advance payment of taxes, the deadline for sending funds to the budget by a legal entity. The amount of the penalty directly depends on the amount of tax collection.

The following tax periods have been established for legal entities:

- first quarter;

- second quarter;

- third quarter;

It is for this reason that it will be necessary to carry out 4 times a year.

It is also important to note that constituent entities of the Russian Federation have the right to refuse to establish any reporting periods. And assign the calculation and payment of tax in one payment for legal entities as such.

This point needs to be worked out in advance. And promptly monitor changes in local tax legislation.

For example, in Moscow and the region, advance payments are simply not provided for.

This moment is determined by a special regulatory document - clause 1 of Art. No. 3 dated 07/09/08

At the same time, legal entities registered in the capital will need to transfer the tax in a lump sum before February 5 of the year immediately following the reporting year.

Things will be somewhat different in the case of the northern capital - St. Petersburg. In this city and the Leningrad region, it is necessary for legal entities to send advance payments.

The first three payments are made as follows:

- until April 30;

- until July 31;

- until October 30.

The last tax payment must be made before February 10. The dates indicated above imply payment for the previous year - which precedes the submission of reports.

This issue is determined by special local legislation - clause 2 of Art. No. 3 dated November 4, 2002 “On transport tax.” Accordingly, in all other regions things are similar.

It may or may not be required to be implemented. This point is best worked out in advance.

Especially if the legal entity was registered relatively recently. And the person responsible for reporting does not yet have the relevant experience.

What are the rates for regions of Russia?

Transport tax rates in the Russian Federation may differ in different cities. Since, according to the Tax Code of the Russian Federation, subjects are free to set the amount of payment at their own discretion.

For 2019, rates are determined as follows (up-to-date information from the official websites of the Federal Tax Service):

| Region name | Moscow | St. Petersburg | Amur |

| Less than 100 hp | 12 | 24 | 15 |

| More than 100, but less than 125 hp. | 25 | 35 | 21 |

| From 125 to 150 hp | 35 | 35 | 21 |

| From 150 to 175 hp | 45 | 50 | 30 |

| From 175 to 200 hp | 50 | 50 | 30 |

| From 200 to 225 hp | 65 | 75 | 75 |

| From 225 to 250 hp | 75 | 75 | 75 |

| More than 250 hp | 150 | 150 | 150 |

Table continuation:

| Region name | Astrakhan | Magadan | Smolensk region |

| Less than 100 hp | 14 | 6 | 10 |

| More than 100, but less than 125 hp. | 27 | 8 | 20 |

| From 125 to 150 hp | 27 | 8 | 20 |

| From 150 to 175 hp | 48 | 12 | 40 |

| From 175 to 200 hp | 48 | 12 | 40 |

| From 200 to 225 hp | 75 | 18 | 66 |

| From 225 to 250 hp | 75 | 75 | 18 |

| More than 250 hp | 150 | 30 | 110 |

It often happens that an enterprise simultaneously has many expensive, powerful cars on its balance sheet. In this case, you can use some methods to reduce the bet amount.

Currently the most effective:

- reducing the power of the car - it is possible to install a less powerful engine or simply try to forge documents with the help of friends in the traffic police;

- take advantage of certain benefits - this is problematic for legal entities, but some regions provide benefits in some cases;

- register a car in a region where the tax rate for vehicles is significantly lower.

For legal entities in St. Petersburg. and other cities is determined individually, in accordance with special regulatory documents.

It is best to work out this question in advance. This will allow you to perform the calculation yourself and also avoid mistakes.

Underpayment of transport tax to the budget (and the accrual is made specifically to the local budget, not the federal budget) involves significant penalties, as well as fines. It is also important to remember to submit your tax return on time.

Taxation is one of the important areas of doing business. If you do not have the necessary experience, you need to get advice.

Today there are many institutions involved in the preparation of tax reporting in outsourcing mode. It is assumed that tax reporting will be generated on-site.

How to calculate the amount

Calculating the amount of transport tax is an important step. Therefore, you need to familiarize yourself with the formula for calculation on the Federal Tax Service website. All required additional information is also provided there.

Regarding the timing of payment in a specific region and the rate in the subject, as well as other points. It is important to pay maximum attention to the nuances. Errors in tax calculations arise precisely because of subtle features of calculation.

Formula

A formula is determined for calculating transport tax in accordance with a special regulatory document - clause 3 of Article No. 363.1 of the Tax Code of the Russian Federation.

Standard formula for calculating transport tax:

RN = CH × NB × (number of months of ownership/12) × increasing factor,

Separately, it is necessary to consider the issue of using a multiplying factor. It is worth noting that this applies only to certain types of cars. Need to use it.

A complete list of such cars, the ownership of which requires the use of a PC (increasing factor), is reflected on the official website of the Ministry of Industry and Trade.

Moreover, if at a particular point in time a certain car is not on the list, but previously it was there, it will be necessary to use an increasing coefficient.

Otherwise, non-use is considered an error. There will be underpayment. As a result, the absence of payment fact, the accrual of penalties and fines.

Example

The easiest way to familiarize yourself with the process of paying the amount of transport tax is with a simple example:

Kontur LLC owns a vehicle with an engine power of 100 hp. The region has established a tax rate of 25 rubles for each horsepower for this type of car.

In this case, the car is not included in the list for which a special increasing factor is applied. The tax amount will be

100 hp × 25 rubles = 2,500 rubles.

How to calculate penalties

Sometimes it happens that for some reason the transport tax was not paid on time or a penalty was imposed due to underpayment or another reason.

In this case, the legal entity will again need to independently carry out calculations and payments. The easiest way to understand this procedure is with a simple example:

The amount of the penalty is 1/300 of the refinancing rate of the Central Bank of the Russian Federation. Kontur LLC failed to pay part of the tax due to an incorrect calculation.

The amount of non-payment will be 1 thousand rubles. For each day of delay, a penalty was charged in the amount of 1/300 of the rate. Number of days – 30.

Accordingly, for each day of delay - 3 rubles. 30 days × 3 rubles – 90 rubles of penalties will need to be paid to Kontur LLC.

Where to pay

On the official website of the tax service, the codes of income classifications of the Russian Federation are indicated. For organizations that were registered in Moscow, information can be obtained at https://www.nalog.ru/rn77/taxation/kbk/yul/nitz/tn/tno/.

The following is presented:

How to fill out a payment order

The transport tax is obliged to be paid to the state treasury by the persons in whose name the vehicles are registered. The declaration is submitted at the place of registration of the car. Procedures, terms, payment amounts are determined at the regional level. What is a budget classification code, for what purpose is it used, and what are the risks of making mistakes - all this will be discussed in the article.

Procedure for calculating and paying transport tax for legal entities

Taxpayers are persons who own certain vehicles. This position is expressed in Art. 357 Tax Code of the Russian Federation.

Since transport tax rates are finally approved at the regional level, to check the calculation and simplicity it is better to use the online calculator on the Federal Tax Service website (the correct result will be obtained if you initially select the appropriate region, for example, Moscow).

The electronic form of the calculator is designed in such a way that a person can use hints or built-in reference books at any time. This will allow you not to miss the need to apply additional coefficients in the formula (KP - increasing coefficient for luxury cars, KV - indicator of the duration of ownership of a car property).

If we are talking about legal entities, they are engaged in the calculation of fiscal obligations independently. This amount is calculated as the difference obtained between the calculated amount and the amounts of advance payment documents within the reporting period (Article 362 of the Tax Code of the Russian Federation).

When filling out payment documents, code values are required. One of them is KBK (budget classification code). With its help, you can identify the type of income coming to the budget, group them and account for them.

Payment details

To generate a payment on the Federal Tax Service website, you need to fill out the appropriate electronic form. There are several options that need to be paid in order to competently pay the local budget:

- taxpayer status (individual, individual entrepreneur or legal entity);

- BCC of a specific tax contribution (in this case we are talking directly about the transport fee);

- the value of OKTMO to determine a specific territorial affiliation;

- the basis within which the payment transaction is carried out (traditionally, “current payment” or “debt” is noted);

- displaying the period for which the fee is paid;

- payment made on the basis of administrative documentation;

- the date on which a specific paper is filled out;

- order related to the transfer of finances.

If necessary, you may need to enter other details and data.

Deadlines for payment of transport tax for legal entities in 2019

The time frame allocated for payment of transport tax is traditionally determined at the local level. Organizations make payments of two types.

Time frames for ordinary citizens and legal entities also differ.. You can clarify them on the website of the local Federal Tax Service or contact the service in person and by phone number.

Rules for filling out a payment order

The rules for filling out a payment form for transport tax are the same as in the case of processing payments for other groups of taxes. However, there are several nuances to take into account. The general requirements are present in the Order issued by the Ministry of Finance on November 12, 2013 No. 107n.

If we take into account the fact that payment of the obligation is carried out at the place of registration of the car or other vehicle (Article 363 of the Tax Code of the Russian Federation, clause 1), the main nuance that the payer must understand is the establishment of the recipient’s details. The main point that needs to be indicated is the data on the Federal Tax Service, which provides service to the address of the location of the transport. As such a place in accordance with Art. 83 of the Tax Code of the Russian Federation, paragraph 5, recognizes:

- place of state registration (for water transport with the exception of small vessels);

- territory where the enterprise is located, if we are talking about air transport units;

- location of the company for other units of equipment.

An important role is played by filling out the field numbered “107”. In accordance with the general rule prescribed in Art. 360 of the Tax Code of the Russian Federation, paragraph 2, the tax period is a year. Therefore, the order of document execution depends on payment period:

- 1st quarter – KV.01.ХХХХ*;

- 2nd quarter – KV.02.ХХХХ*;

- 3rd quarter – KV.03.ХХХХ*;

- annual period – GD.00.ХХХХ*.

Regional authorities have the opportunity not to establish reporting periods (clause 3 of Article 360 of the Tax Code of the Russian Federation). Therefore, payers will not be able to make advances on transport tax. However, field 107 is still required to be filled out.

List of KBK for transport tax in 2019

The main meanings of this number for legal entities are as follows:

- main payment, arrears on payment and carrying out the corresponding recalculation - 182 1 06 04011 02 1000 110;

- penalties accrued as part of the payment: 182 1 06 04011 02 2100 110;

- percentage values for rates and other charges: 182 1 06 04011 02 2200 110;

- penalties provided for disobedience (violations of legislation under the Tax Code of the Russian Federation): 182 1 06 04011 02 3000 110.

This list, at one time or another, is subject to certain changes and requires mandatory adjustments with any change in legislation.

The structure of the KBK code, what information is encrypted in it?

The structure of the code value plays an important role. Conventionally, it contains 3 parts. The first three digits indicate the recipient of the funds. For the tax service, this parameter is “182”. In numbers 4 to 13 there is an encrypted income format. And in the interval from 14 to 20, a specific subtype is assumed.

The budget level into which the payment is made is present in the 12th and 13th digits of the code. Within the range from 14 to 17 digits, the type of payment being made is displayed. In the situation with the Federal Tax Service, there are only 4 options: payment, penalty, interest or penalties. At the end of the reporting period, the value 110 is indicated within the “tax income” group.

The budget level into which the payment is made is present in the 12th and 13th digits of the code. Within the range from 14 to 17 digits, the type of payment being made is displayed. In the situation with the Federal Tax Service, there are only 4 options: payment, penalty, interest or penalties. At the end of the reporting period, the value 110 is indicated within the “tax income” group.

An important role is played by indicating the number value that is current on a certain date.. In comparison with the 2017 period, digital combinations were not subject to changes. Within the framework of the studied BCC parameter, this fee is related to the category “property taxes”. Thus, the KBK has a very simple and understandable structure, while including many functional values and parameters.

Errors when specifying code and their consequences

If the code numbers contain erroneous information, the payment simply will not be received as intended. And this will mean delays and the accrual of penalties in the future.

When the debt reaches a certain size, the tax service will issue a fine, which for legal entities is around 100,000 Russian rubles. To avoid problems with the law, you should monitor the tax repayment process and do it in a timely manner.

Ways to correct the situation

If an error is detected to a legal entity a special application should be sent to the Federal Tax Service in order to clarify the code. The inspection has 10 working days to study this issue and make a further final decision.

Most often, tax officials independently correct mistakes and give taxpayers further recommendations.

How to check the relevance of the KBK code for transport tax?

You can clarify the information about the required code designation within the framework of the Federal Tax Service by following the links:

- To do this, you need to indicate the taxpayer you are interested in and the type of documentation.

- In the field with the name of the payment, select “transport tax”, and in the “type of payment”, click on the required option.

- As a result, the desired code value will be displayed. It must be used to perform further actions to pay the fee.

The main source of information is the official web resource of the Federal Tax Service. It contains the necessary set of data that facilitates the correct and timely payment of the transport fee.

Thus, in 2019, legal entities pay transport tax according to general rules, which have not been subject to recent changes. The general deadline for submitting the declaration is February 1.

The procedure for calculating the tax liability for vehicles of legal entities and individuals is described below.

The corporate transport tax is one of many taxes required to be paid by any legal entity. We will consider below what the transport tax will be for legal entities in 2017 and when it must be paid, and whether we should expect it to be abolished at all.

How to calculate transport tax for legal entities in 2017

Transport tax for legal entities in 2017 can be calculated using a simple formula: the tax base is multiplied by the tax rate. True, the formula may contain an amendment with decreasing or increasing coefficients (for example, for expensive cars that cost several million rubles), and each region of Russia has the right to change the tax rate relative to the base value in any direction, while there is only one restriction for changing the rate - it should not differ in any direction by more than ten times from the base one. Therefore, the amount of taxes is very individual and will differ noticeably from one Russian region to another.

The tax rate for transport tax in 2017 for legal entities is established in each region independently, so an organization’s accountant can find out the current rate in his/her constituent entity on the website of the local Federal Tax Service inspectorate or directly at the inspectorate.

As any accountant knows, the responsibility for calculating this tax lies with the legal entity itself, and the report to the Federal Tax Service is submitted in the form of a declaration, and the tax authorities only check, relying, among other things, on the traffic police database, whether the accounting department has calculated the amount of taxes correctly and in full whether the payment was made. Therefore, you need to treat this work as carefully as any other accounting activity - the tax authorities will definitely not praise you for an error.

Deadlines for payment of transport tax for legal entities in 2017

The declaration for this tax must be filed by a legal entity before February 1, 2017. In those regions where payment of this tax for legal entities is provided once a year, the same date is the deadline for making payments to the budget for the accrued tax. True, in the overwhelming majority of federal subjects this tax is still paid by legal entities in advance once a quarter, and the deadline for paying the tax is the entire next month after the end of the quarter. That is, based on the results of the first quarter of 2017, the tax will need to be paid by April 30, based on the results of the second quarter - by July 31, etc.

It must be remembered that in 2017 the system of budget classification codes is changing, but the BCC for transport tax will remain the same.

A sample declaration if necessary (if, for example, you are encountering this for the first time) can easily be found on the Internet or at the local tax authority.

Can transport tax be abolished for legal entities?

Discussions about abandoning this tax have been going on for quite some time. One main injustice applies to both ordinary Russians and Russian legal entities - in fact, the owners of any transport pay tax for road use twice. In addition to the tax itself, there are excise taxes on fuel, which more adequately reflect the degree and frequency of use of the car, and those cars that drive on the roads more often bring more money to the budget due to excise taxes. Even increasing coefficients for expensive and powerful vehicles are initially included there, albeit indirectly, since such cars consume an insane amount of fuel. As a result, a paradox arises, which does not exist in any other country in the world, when the same collection is collected twice under different forms.

However, if tax abolition was not discussed in the “fun” years, it is especially not worth expecting it now, when the government is looking for any ways to reduce the budget and is cutting even socially significant expenses, and is looking for more and more new ones to increase revenues. new ways to raise money even from the ordinary population. What to say about business. It is obvious that the authorities will not refuse such a good way to replenish the state budget even in relation to ordinary citizens, especially since this thesis will be fair in relation to fees from organizations and enterprises. Therefore, businesses will need to survive without hope of help from the state.