The Federal Tax Service has changed the rules for accepting balances for. Error when filling in Contour.Extern. Section II. Current assets

Kontur.Extern has an automatic converter for accounting forms:

- Forms No. 1-6 Accounting statements (KND 0710099);

- Simplified accounting (financial) statements (KND 0710096);

- Report on the financial results of the institution (KND 0503721).

To submit the form in the current format, upload the finished file into the program. If the report was generated in the old format, Kontur.Extern will automatically transfer the data from the old format to the new one.

For other accounting forms, data can be transferred manually. For this:

- Upload file

- Click "Save and Close";

- Go to the Federal Tax Service section > Fill in the system > select the report form > “Fill out the report”;

- The first time you enter the report form, there will be no data. To transfer data to a new format, click on the “Transfer data” link.

If you have never entered the format of the earlier version, edited the report data or downloaded the finished file, then in the latest version there will be no data transfer.

Error when filling in Contour.Extern

The error occurs if the wrong period is selected when filling out the report. To fix it, go to the correct version of the report and generate it again.

To do this, go to the Federal Tax Service section > Fill out in the system > select a form > click on the “Select period” button > select the period for which you want to generate a report > “Fill out the report.”

If you have just started filling out the report, then Kontur.Ekstren will automatically open the correct report format.

The general form of the balance sheet is given in Appendix No. 1 to Order No. 66n.

You cannot remove any lines from the approved form, but you can enter additional ones if you wish.

For example, if an organization wants to separately show deferred expenses in the balance sheet, then you can independently add a special line to the “Current assets” section.

The balance sheet in its general form has columns in which the following indicators are given for each item:

- as of the reporting date (when filling out the balance sheet for 2016 - as of December 31, 2016);

- as of December 31 of the previous year (when filling out the balance sheet for 2016 - as of December 31, 2015);

- as of December 31 of the year preceding the previous one (when filling out the balance sheet for 2014 - as of December 31, 2014).

Organizations add column 3 independently to enter the line code in it.

The balance sheet contains two parts - assets and liabilities, which must be equal to each other.

The asset reflects the amount of non-current and current assets, and the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

The codes of indicators that are indicated in the balance sheet are given in Appendix No. 4 to Order of the Ministry of Finance dated July 2, 2010 No. 66n.

Rules for filling out the balance

The balance sheet is always drawn up for a specific date (clause 18 of PBU 4/99).In addition, the balance sheet provides similar data as of December 31 of last year and the year before (clause 10 of PBU 4/99).

This data must be taken from the balance sheet for the previous year.

To fill out the balance sheet, you must create a balance sheet for all accounts for the year.

Based on the balances of accounting accounts (subaccounts) from the turnover balance sheet, balance sheet lines are formed.

If the balance sheet does not contain data to fill out any lines of the balance sheet (for example, line 1130 “Intangible exploration assets”, line 1140 “Tangible exploration assets”), then in this case a dash is added (Letter of the Ministry of Finance dated 01/09/2013 No. 07 -02-18/01).

The procedure for filling out individual balance lines

Now let's look at the procedure for filling out individual balance lines.Section I. Non-current assets

Intangible assets. The residual value of intangible assets is reflected on line 1110. Clause 3 of PBU 14/2007 “Accounting for intangible assets”, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n, allows you to find out what belongs to this group. Thus, in order to accept an object for accounting as an intangible asset, it is necessary that the following conditions be simultaneously met:- the object is capable of generating economic benefits in the future, and the organization has the right to receive them;

- the object can be separated or separated (identified) from other assets;

- the object is intended for use for a long time, that is, its useful life exceeds 12 months;

- it is possible to reliably determine the actual (initial) cost of the object;

- the object lacks a material form.

Intangible assets do not include expenses associated with the formation of a legal entity (organizational expenses), intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Results of research and development. Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets. These two indicators are given in lines numbered 1130 and 1140. They are intended for organizations - users of subsoil to reflect information on the costs of developing natural resources (PBU 24/2011 “Accounting for the costs of developing natural resources”, approved by Order of the Ministry of Finance of Russia dated October 6, 2011 No. 125n).

Fixed assets. For depreciable objects, the residual value of fixed assets is recorded in line 1150. If we are talking about non-depreciable property, then the line indicates its original cost. Assets classified as fixed assets must comply with the conditions of clause 4 of PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

Objects must be owned by the organization or have the right of operational management or economic management. It is also allowed to include property received under a leasing agreement as fixed assets if it is taken into account on the balance sheet of the lessee.

Objects subject to mandatory state registration of property rights are considered fixed assets from the moment they are registered, that is, like all other objects. The fact that documents are submitted to the appropriate authority does not matter.

In Sect. Form I of the balance sheet does not have the line “Construction in progress”.

The question arises: Which balance sheet item should be used to record expenses for the construction of real estate?

Answer: on line 1150 “Fixed assets”. This is stated in paragraph 20 of PBU 4/99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n. It’s best to add the decoding line “Unfinished construction” to line 1150, according to which you can record the named expenses.

Profitable investments in material assets. Data on profitable investments in material assets corresponds to line indicator 1160. This is the residual value of property intended for rent (leasing) and accounted for on account 03. If the property was first used for production and management needs, but was later leased out, it must be reflected in a separate subaccount of account 01 as part of fixed assets. This is due to the fact that the transfer of the value of fixed assets into profitable investments and back is not provided for in accounting (Letter of the Federal Tax Service of Russia dated May 19, 2005 No. GV-6-21/418@).

Financial investments. For long-term financial investments, that is, with a circulation period of more than a year, line 1170 is allocated (for short-term ones - line 1240 of section II “Current assets”). Investments in subsidiaries, affiliates and other companies are also shown here. Financial investments are taken into account in the amount spent on their acquisition.

The cost of own shares purchased from shareholders for resale or cancellation, and interest-free loans issued to employees are not considered financial investments (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n). For the first indicator, line 1320 is provided. The second indicator is reflected as part of accounts receivable, namely, long-term loans are shown on line 1190, short-term loans - on line 1230.

Deferred tax assets. Line 1180 “Deferred tax assets” is filled in by income tax payers. Since “simplified people” are not included in their number, it must be marked with a dash.

Other noncurrent assets. Here (line 1190) shows data on non-current assets that are not reflected in other lines of section. I balance sheet.

Section II. Current assets

Inventories. The cost of inventories is reflected on line 1210. Previously, this indicator had to be deciphered. In the current form, decryption is not required. However, it is needed if the indicators included in line 1210 are significant. In this case, you should add decryption lines, for example:- raw materials and materials;

- costs in work in progress;

- finished products and goods for resale;

- goods shipped, etc.

Accounts receivable. This line 1230 is intended for short-term receivables, that is, repayment of which is expected within 12 months after the reporting date.

Financial investments (excluding cash equivalents). For these assets, line 1240 is provided, which, in particular, shows loans provided by the organization for a period of less than 12 months.

If you are determining the current market value of financial investments, use all sources of information available to you, including data from foreign organized markets or trade organizers. Such recommendations are contained in the Letter of the Ministry of Finance of Russia dated January 29, 2009 02/07/18/01. If at the reporting date you cannot determine the market value of a previously assessed object, reflect it at the cost of the last assessment.

Cash and cash equivalents. To fill out the line, you need to sum up the value of cash equivalents (the balance of the corresponding subaccounts of account 58) and the balances of cash accounts (50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts”, 55 “Special accounts in banks” and 57 “Transfers” on my way").

The concept of cash equivalents, we recall, is contained in the Accounting Regulations “Cash Flow Statement” (PBU 23/2011), approved by Order of the Ministry of Finance of Russia dated 02.02.2011 No. 11n. Cash equivalents may include, for example, demand deposits opened with credit institutions.

Other current assets. Here (line 1260) shows data on current assets that are not reflected in other lines of section. II balance.

Section III. Capital and reserves

Authorized capital (share capital, authorized capital, contributions of partners).Line 1310 of the balance sheet reflects the amount of the company's authorized capital. It must coincide with the amount of the authorized capital, which is recorded in the constituent documents of the company.

Own shares purchased from shareholders. We have already said that if an organization purchased its own shares (shares of founders) in the authorized capital not for sale, then their value is entered in line 1320. Such shares are supposed to be canceled, which automatically leads to a decrease in the authorized capital, therefore the indicator in this line is given as a negative value in brackets. But if own shares are repurchased and resold, they are already considered an asset and their value must be entered in line 1260 “Other current assets.”

Revaluation of non-current assets. This line is assigned the number 1340 (there is no indicator for line number 1330). It shows the additional valuation of fixed assets and intangible assets, which is taken into account in account 83 “Additional capital”.

Additional capital (without revaluation). The amounts of additional capital are reflected on line 1350. Note that the indicator for this line is taken without taking into account the amounts of revaluation, which should be reflected in the line above.

Reserve capital. The balance of the reserve fund is indicated on line 1360. This reflects both reserves formed as required by law and reserves created in accordance with the constituent documents. Decoding is required only if the indicators are significant.

Retained earnings (uncovered loss). Retained earnings accumulated for all years, including the reporting one, are shown in line 1370. It also reflects the uncovered loss (only this amount is enclosed in brackets).

The components of the indicator (profit (loss) for the reporting year and (or) for previous periods) can be written down in additional lines, that is, a breakdown can be made based on the financial results obtained (profit/loss), as well as for all years of the company’s activity.

Section IV. long term duties

Borrowed funds. Line 1410 is reserved for the debt of the organization itself on long-term (with a repayment period of more than 12 months as of December 31, 2015) loans and credits.Deferred tax liabilities. Line 1420 is filled in by income tax payers. “Simplers” are not included in their number, so they put a dash in this line.

Estimated liabilities. The specified line 1430 is filled in if the organization recognizes estimated liabilities in accounting in accordance with the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n. Let us remind you that small businesses, which are the majority of “simplified” ones, may not apply this PBU.

Other obligations. Here (line 1450) other long-term liabilities are shown that are not reflected in other lines of section. IV balance. Please note that Order No. 66n does not provide an indicator for line 1440.

Section V. Current liabilities

Borrowed funds. Line 1510 indicates debt on short-term loans and borrowings taken out for a period of no more than 12 months. In this case, the amount should be reflected taking into account interest due at the end of the reporting period.Accounts payable. The total amount of accounts payable is recorded in line 1520. And this should only be short-term debt.

Please note that there is no separate line for debt to participants (founders) for payment of income. The amount of such debt should be included here and deciphered on a separate line, since this indicator is always significant.

Revenue of the future periods. Line 1530 is filled in when the accounting provisions provide for the recognition of this accounting object. For example, if your organization receives budget funds or targeted funding. Such funds are precisely subject to accounting as part of deferred income in accounts 98 “Deferred Income” and 86 “Targeted Financing” (clauses 9 and 20 of the Accounting Regulations “Accounting for State Aid” (PBU 13/2000), approved Order of the Ministry of Finance of Russia dated October 16, 2000 No. 92n).

Estimated liabilities. The explanations that we gave for line 1430 apply here: line 1540 is filled out if the company recognizes estimated liabilities in its accounting. Only line 1430 reflects long-term liabilities, and line 1540 - short-term liabilities.

Other obligations. Line 1550 shows other short-term liabilities that are not reflected in other lines of section. V balance.

So, we have looked at the balance sheet items.

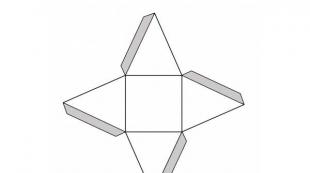

Now we offer a scheme, which will help determine its indicators (we denote the debit and credit balances of the accounting accounts as Dt and Kt, respectively).

- Section I “Non-current assets”

Line 1120 “Results of research and development”= Dt 04 (analytical account for accounting for R&D expenses).

Line 1130 “Intangible exploration assets”= Dt 08 (analytical account of expenses for intangible search costs).

Line 1140 “Tangible Exploration Assets”= Dt 08 (analytical account of expenses for material search costs).

Line 1150 “Fixed assets”= Dt 01 - Kt 02 + Dt 08 (analytical account of expenses for construction in progress).

Line 1160 “Profitable investments in material assets”= Dt 03 - Kt 02 (analytical account for accounting for depreciation of property related to income-generating investments).

Line 1170 “Financial investments”= Dt 58 + Dt 55, sub-account “Deposit accounts”, + Dt 73, sub-account “Settlements for loans provided” (analytical accounts for long-term financial investments), - Kt 59 (analytical account for accounting for reserves for long-term financial investments).

Line 1180 “Deferred tax assets”= Dt 09.

Line 1190 “Other non-current assets”= value of non-current assets not taken into account in other indicators Sec. I balance sheet.

Line 1100 “Total for Section I”= sum of line indicators 1110 - 1190.

- Section II "Current assets"

Line 1220 “VAT on purchased assets”= Dt 19.

Line 1230 “Accounts receivable”= Dt 62 + Dt 60 + Dt 68 + Dt 69 + Dt 70 + Dt 71 + Dt 73 (except interest-bearing loans) + Dt 75 + Dt 76 - Kt 63.

Line 1240 “Financial investments (except for cash equivalents)”= Dt 58 + Dt 55, sub-account “Deposit accounts”, + Dt 73, sub-account “Settlements for loans provided” (analytical accounts for short-term financial investments), - Kt 59 (analytical account for accounting for reserves for short-term financial investments).

Line 1250 “Cash and cash equivalents”= Dt 50 + Dt 51 + + Dt 52 + Dt 55 + Dt 57 - Dt 55, subaccount “Deposit accounts” (analytical accounts for accounting for financial investments).

Line 1260 “Other current assets”= value of current assets not included in other indicators in section. II balance sheet.

Line 1200 “Total for Section II”= sum of line indicators 1210 - 1260.

Line 1600 “Balance”= line indicator 1100 + line indicator 1200.

- Section III "Capital and reserves"

Line 1320 “Own shares purchased from shareholders”= Dt 81. Enclose the indicator in brackets.

Line 1340 “Revaluation of non-current assets”= Kt 83 (analytical account for accounting for amounts of additional valuation of fixed assets and intangible assets).

Line 1350 “Additional capital (without revaluation)”= Kt 83 (except for amounts of additional valuation of fixed assets and intangible assets).

Line 1360 “Reserve capital”= Kt 82.

Line 1370 “Retained earnings (uncovered loss)”= Kt 84 (Dt 84). If there is a debit balance, the indicator is negative (that is, there is a loss), enclose it in brackets.

Line 1300 “Total for Section III”= sum of indicators of lines 1310 - 1370. If the result is negative (if there are negative indicators for lines 1320 and 1370), show it in parentheses.

- Section IV “Long-term liabilities”

Line 1420 “Deferred tax liabilities”= Kt 77.

Line 1430 “Estimated liabilities”= Kt 96 (only estimated liabilities with a maturity period of more than 12 months after the reporting date).

Line 1450 “Other obligations”= long-term debt that is not included in other indicators in section. IV balance sheet.

Line 1400 “Total for Section IV”= sum of the indicators of the above lines 1410 - 1450.

- Section V “Short-term liabilities”

Line 1520 “Accounts payable”= Kt 60 + Kt 62 + Kt 76 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75. In this case, take into account only short-term debt.

Line 1530 “Deferred income”= Kt 98 + Kt 86 in terms of targeted budget financing, grants, technical assistance, etc.

Line 1540 “Estimated liabilities”= Kt 96 (only estimated liabilities with a maturity date of no more than 12 months after the reporting date).

Line 1550 “Other obligations”= amounts of debt on short-term obligations not taken into account when determining other indicators Sec. V balance.

Line 1500 “Total for Section V”= sum of line indicators 1510 - 1550.

Line 1700 “Balance”= row indicators 1300 + 1400 + 1500.

If all business transactions are reflected correctly and correctly transferred to the balance sheet, the indicators of lines 1600 and 1700 will coincide. If this equality is not observed, an error has been made somewhere. Then you need to check, recalculate and adjust the entered data.

Example. Filling out the balance sheet

The LLC, registered in 2016, applies a simplified taxation system.

Balances (Kt - credit, Dt - debit) in the accounting accounts of the LLC as of December 31, 2016

| Balance | Amount, rub. | Balance | Amount, rub. |

|---|---|---|---|

| Dt 01 | 600 000 | Dt 58 | 150 000 |

| Kt 02 | 200 000 | Kt 60 | 150 000 |

| Dt 04 | 100 000 | Kt 62 (sub-account "Advances") | 505 620 |

| Kt 05 | 50 000 | ||

| Dt 10 | 10 000 | Kt 69 | 100 000 |

| Dt 19 | 10 000 | Kt 70 | 150 000 |

| Dt 43 | 90 000 | Kt 80 | 50 000 |

| Dt 50 | 15 000 | Kt 82 | 10 000 |

| Dt 51 | 250 000 | Kt 84 | 150 000 |

Based on the available data, the accountant compiled a balance sheet for 2016 in a general form:

| Explanations | Indicator name | Code | As of December 31, 2016 | As of December 31, 2015 | As of December 31, 2014 |

|---|---|---|---|---|---|

| ASSETS | |||||

| I. NON-CURRENT ASSETS | |||||

| - | Intangible assets | 1110 | 50 | - | - |

| - | Research and development results | 1120 | - | - | - |

| - | Intangible search assets | 1130 | - | - | - |

| - | Material prospecting assets | 1140 | - | - | - |

| - | Fixed assets | 1150 | 400 | - | - |

| - | Profitable investments in material assets | 1160 | - | - | - |

| - | Financial investments | 1170 | 150 | - | - |

| - | Deferred tax assets | 1180 | - | - | - |

| - | Other noncurrent assets | 1190 | - | - | - |

| - | Total for Section I | 1100 | 600 | - | - |

| II. CURRENT ASSETS | |||||

| - | Reserves | 1210 | 107 | - | - |

| - | Value added tax on purchased assets | 1220 | 10 | - | - |

| - | Accounts receivable | 1230 | - | - | - |

| - | Financial investments (excluding cash equivalents) | 1240 | - | - | - |

| - | Cash and cash equivalents | 1250 | 265 | - | - |

| - | Other current assets | 1260 | - | - | - |

| - | Total for Section II | 1200 | 375 | - | - |

| - | BALANCE | 1600 | 975 | - | - |

| Explanations | Indicator name | Code | As of December 31, 2016 | As of December 31, 2015 | As of December 31, 2014 |

|---|---|---|---|---|---|

| PASSIVE | |||||

| III. CAPITAL AND RESERVES | |||||

| - | Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 50 | - | - |

| - | Own shares purchased from shareholders | 1320 | (-) | (-) | (-) |

| - | Revaluation of non-current assets | 1340 | - | - | - |

| - | Additional capital (without revaluation) | 1350 | - | - | - |

| - | Reserve capital | 1360 | 10 | - | - |

| - | Retained earnings (uncovered loss) | 1370 | 150 | - | - |

| - | Total for Section III | 1300 | 210 | - | - |

| IV. LONG TERM DUTIES | |||||

| - | Borrowed funds | 1410 | - | - | - |

| - | Deferred tax liabilities | 1420 | - | - | - |

| - | Estimated liabilities | 1430 | - | - | - |

| - | Other obligations | 1450 | - | - | - |

| - | Total for Section IV | 1400 | - | - | - |

| V. SHORT-TERM LIABILITIES | |||||

| - | Borrowed funds | 1510 | - | - | - |

| - | Accounts payable | 1520 | 765 | - | - |

| - | revenue of the future periods | 1530 | - | - | - |

| - | Estimated liabilities | 1540 | - | - | - |

| - | Other obligations | 1550 | - | - | - |

| - | Total for Section V | 1500 | 765 | - | - |

| - | BALANCE | 1700 | 975 | - | - |

Column 4 is the only one that requires filling out by the newly created organization. This column reflects data as of December 31 of the reporting year, that is, 2016.

Column 3 is also added to indicate line codes.

Index lines 1110 The accountant defined “intangible assets” as follows: the credit balance of account 05 is subtracted from the debit balance of account 04.

In total we get 50,000 rubles. (100,000 rubles - 50,000 rubles). All values on the balance sheet are in whole thousands, so line 1110 shows 50.

The indicator of line 1150 “Fixed assets” is defined as follows: debit balance of account 01 - credit balance of account 02. Result—400,000 rubles. (600,000 rub. - 200,000 rub.). 400 is recorded in the balance sheet.

IN line 1170“Financial investments” the debit balance of the account is entered 58 - 150 thousand rubles. (that is, it is considered that all investments are long-term).

Total for summary line 1100: 827 thousand rubles. (97 thousand rubles (line 1110) + 580 thousand rubles (line 1150) + 150 thousand rubles (line 1170)).

Now it’s the turn of current assets. The value of line 1210 “Inventories” is defined as follows: debit balance of account 10 + debit balance of account 43. The result is 100 thousand rubles. (10 thousand rubles + 90 thousand rubles).

The indicator in line 1220 “Value added tax on acquired assets” is equal to the debit balance of account 19, therefore the accountant added 10 thousand rubles to the balance sheet.

Index lines 1250“Cash and cash equivalents” was found by adding the debit balance of account 50 and the debit balance of account 51. The result is 265 thousand rubles. (15 thousand rubles + 250 thousand rubles). The line contains 265.

Summary result line 1200: 378 thousand rubles. (107 thousand rubles (line 1210) + 6 thousand rubles (line 1220) + 265 thousand rubles (line 1250)).

According to the final line 1600 the sum of the indicators of lines 1100 and 1200 is shown. That is, 1205 thousand rubles. (827 thousand rubles + 378 thousand rubles).

The remaining lines of column 4 are filled with dashes.

Let's move on to the balance sheet liability. Indicator for line 1310“Authorized capital (share capital, authorized capital, contributions of partners)” is equal to the credit balance of account 80, that is, the balance sheet costs 50 thousand rubles.

Line 1360“Reserve capital” is the credit balance of account 82. In our case, it is 10 thousand rubles.

IN line 1370“Retained earnings (uncovered loss)” shows the balance of account 84. It is a credit balance. This means that the organization has a profit at the end of the year. Its value is 150 thousand rubles. There is no need to put the indicator in brackets.

The summary line indicator 1300 is equal to 210 thousand rubles. (50 thousand rubles (line 1310) + 10 thousand rubles (line 1360) + 150 thousand rubles (line 1370)).

Indicator for lines 1520“Accounts payable” (the accountant considered that all debt is short-term) is defined as follows: credit balance of account 60 + credit balance of account 62 + credit balance of account 69 + credit balance of account 70. The result is 765 thousand rubles. (150 thousand rubles + 500 thousand rubles + 100 thousand rubles + 15 thousand rubles).

IN line 1500 The accountant transferred the value from line 1520, since the other lines of section. V balance sheets were not filled out.

Final indicator lines 1700 equal to the sum of lines 1300 and 1500. The resulting value is 975 thousand rubles. (210 thousand rubles + 765 thousand rubles).

The remaining liability lines are crossed out due to the lack of relevant data.

The indicators for the total lines 1600 and 1700 are equal. In both lines the value is 975 thousand rubles.

At the end of 2016, all organizations must submit annual financial statements. We will tell you about its composition, deadlines and addresses for submitting reports in our consultation.

Composition of the annual financial statements 2016.

The annual financial statements consist of a balance sheet, a statement of financial results and appendices to them (Part 1 of Article 14 of the Federal Law of December 6, 2011 No. 402-FZ).

- Statement of changes in equity;

- Cash flow statement;

- Report on the intended use of funds (for non-profit organizations);

- other applications (explanations).

We talked about the composition of the reporting of organizations that have the right to use simplified accounting in.

The forms of annual financial statements for 2016 were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Here are easy-to-download forms of annual financial statements for 2016 with the “Code” column:

The form of the explanatory note to the 2016 annual financial statements has not been approved, therefore the organization determines the format and procedure for presenting explanations independently. Explanations can be presented in tabular or text form. When forming explanations in tabular form, an organization must take into account the example given in Appendix No. 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

When and where to submit annual reports

An organization must submit its annual financial statements at its location no later than March 31 to the following addresses:

- to the tax office (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation);

- territorial statistics body (Article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

If March 31 coincides with a weekend, reports can be submitted no later than the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

For 2016, annual reports must be submitted to the Federal Tax Service and Rosstat.

Financial statements submitted to the Federal Tax Service on paper must be drawn up on machine-readable forms.

Machine-readable financial reporting forms in PDF can be downloaded from.

If an organization is subject to mandatory audit (Article 5 of Federal Law No. 307-FZ of December 30, 2008), an audit report must also be submitted to Rosstat as part of the annual financial statements, which confirms the reliability of the financial statements presented (Clause 5 of PBU 4/99). If at the time of submitting reports to the statistical authorities, the audit in the organization has not been completed, the report can be submitted later. This must be done no later than 10 business days from the day following the date of the audit report, but certainly before December 31 of the year following the reporting year inclusive (clause 2 of Article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

Organizations are not required to submit an audit report to the tax office.

1. Setting up the BGU 1.0 configuration for correct unloading of the balance sheet.

To generate financial statements of state (municipal) budgetary and autonomous institutions in electronic form in formats, processing is used.

Processing for uploading financial statements “Uploading Reporting for the Federal Tax Service.epf” you can download, or find it in the subdirectory " AppData\Roaming\1C\1Cv82\tmplts\1c\StateAccounting\ latest configuration version BGU1.0 \cases\extrp.zip» .

Processing should be added to the program. To do this, go to the menu. Further “Upload log” → “Settings” → “Export formats”. In the window that opens, click "Create", and then, in the next window, click "Load from file..." and select the downloaded file.

After that in the window "Upload format (creation)" click "Save and close".

2. Unloading the balance sheet from the BGU1.0 configuration.

Go to menu “Accounting → Regulated reports → Accounting statements”. Further " Report log", and click the " Unloading».

In the window that opens " Uploading reports" make the following settings:

- Mark the reports prepared for downloading, if necessary, using the filters on the left side of the window

- On the right side of the window, in the item "Exchange Format" select previously loaded processing “Uploading Reporting for the Federal Tax Service.epf”.

- Select "Unloading method" And "Unloading path"

- In field " Correction number" indicate the type of document ( 0 - primary document, from 1 before 999 - correction number for the correcting document).

- After that, click the button Upload data»

Attention! As a general rule, reports with the status “ Prepared" or " Approved" This status is set for reports that have successfully passed the indicator reconciliation control.

Upon completion of unloading, it will open “Protocol for uploading reports”.

- Go to the menu " Accounting» → « Regulated reports" and select " Tax and statistical reporting».

- In the window that opens, click the button Go" and select " External electronic reporting views».

- Click the button Download" and select the desired file.

- Check that the report details are filled out correctly, click " Write down" and send the report by clicking the " button Dispatch» - « Send».

To submit an accounting report for 2016, you need to use a new form to submit information about the company’s balance sheet. This article publishes how to correctly fill out this form line by line, as well as a specific example of a fully completed document

09.11.2016Accounting structure for 2016

Accounting reporting documentation for 2016 is transferred by companies to two services at their location:

statistical;

tax

For the current year 2016, the following accounting reports are submitted:

balance sheet;

income statement;

attachments to the two named reports (depending on the situation, these may be reports relating to changes in capital, financial movements, and the intended use of funds).

The legislation also provides that explanations can be added to the accounting records, which are presented in the form of texts or tables. But the auditor's report must be attached without fail. It contains confirmation of the accuracy of all accounting documents. But this is done in the case when the company is subject to an audit - Federal Law, Law No. 402, Article 13, paragraph 10.

Non-profit companies also submit accounting reports, the structure of which is as follows:

targeted use of funds;

attachments to mandatory reports.

For individual entrepreneurs, there is no need to submit such accounting reports. For small businesses, it is possible to submit accounting reports in a simplified version. Here are its main nuances:

The balance sheet immediately includes reporting data on financial performance, but without detail.

The appendices contain only the information that is needed to assess the financial position of a given company or to assess its financial performance.

If there is no information to complete the above applications, only the required forms are filled out - a balance sheet and financial results report. These rules are confirmed by the following official documents:

order No. 66n (clause 6);

letter No. 03-02-07/1-80 of the Ministry of Finance of our state;

information No. PZ-3/2010 of the Ministry of Finance (clause 17).

When should the balance sheet for the current year 2016 be submitted?

Accounting statements for the annual period are submitted by firms to the local tax service within 3 months from the end of the reporting period, that is, a year - Tax Code, Article No. 23 (clause 1, subclause 5). This report is submitted to the statistical service within the same time frame - Federal Law, Law No. 402, Article 18 (clause 2).

A reporting document containing information about the company’s balance sheet for 2016 is submitted to the relevant departments of local services by March 31 of the following year (in our case, 2017). Interim accounting reports, which are prepared by the company for the convenience of accounting, do not need to be submitted to the tax and statistical services.

Blank report forms (current for 2016-2017)

Download blank forms for filling out a balance sheet:

Features of the simplified form of financial reporting for the current year 2016

Simplified accounting (financial) reporting includes a Balance Sheet, a Statement of Financial Results and a Report on the Purposeful Use of Funds. The following key dates are used for the 2016 report:

In the simplified form of the balance sheet, two mandatory parts are filled in:

asset - non-current and circulating quantities;

liability - the amount of your capital, borrowed finance, accounts payable.

The final results for these sections are recorded in C1600 and C1700, and their digital values must be equal to each other. The remaining lines also have their own encoding, which is entered in an additional column (this is entered into the report independently). This coding is affixed to the digital indicator, which has the largest share in the aggregated indicator - order No. 66n (clause 5).

The consolidated items of the balance sheet according to the simplified tax system for 2016 include:

| 1. Tangible non-current assets (fixed funds + unfinished capital investments in them). | 1. Capital and reserves (authorized capital + additional and reserve capital + retained earnings + uncovered loss + revaluation of fixed assets (intangible assets) + own shares (which were purchased for subsequent cancellation) or shares of the founders). |

| 2. Intangible, financial non-current assets (intangible assets + long-term funds, including research results, unfinished investments in intangible assets, research). | 2. Long-term borrowed funds (money received as a result of loans or long-term loans). |

| 3. Inventories (the same item exists in the general version of the balance sheet). | 3. Short-term borrowed funds (money received from short-term loans or credits). |

| 4. Cash and equivalents (the same item exists in the general version of the balance sheet). | 4. Accounts payable (a digital indicator of the amount of short-term debt a company has to creditors). |

| 5. Financial and other current assets (short-term investments + accounts receivable + other assets). | 5. Other obligations (short-term and long-term). |

Features of the general form of the balance sheet for 2016

The specifics of the general form of the balance sheet are presented in Order No. 66n, namely in Appendix No. 1 to it. This form can also be used by small businesses, although a simplified version of this report has been developed for them.

The balance sheet for this form also contains several columns that should reflect indicators for the following dates (for 2016):

Let us now consider all the nuances for each column separately.

No. 1 - the number of the explanation to the balance sheet is indicated (if there is an explanatory note),

No. 3 - additionally added column for line-by-line encoding.

Like the simplified form, the general one has two main parts:

Asset - reflects the size of all assets, both current and non-current.

Liability - reflects the amount of your own capital + borrowed funds + accounts payable.

Let's break down the balance sheet by section:

Section No. 1 - non-current assets.

Intangible assets. C1110 prescribes the residual value of intangible assets (in accordance with Order No. 153n of the Ministry of Finance of our state, namely with paragraph No. 3 of PBU 14/2007).

Intangible assets include those that meet the following criteria:

ability to generate economic benefits;

possibility of identification (separation/separation) from other assets;

intended for use over a long period of time (over 12 months);

reliable determination of the initial cost of the object (in fact);

there is no material form available.

Example: if the above conditions coincide, then the object is classified as an intangible type of asset - these are works of science, literature, art, various inventions, secret developments, trademarks, etc. In addition, they can also include business reputation, which may appear when purchasing a company as a property complex (although this may only be part of it).

Experts recommend paying attention to the following nuance: intangible assets cannot include expenses that are associated with the organization of the company itself (legal entity), the quality of the company’s personnel - intellectual and business, qualifications and attitude to work - PBU 14/2007, paragraph 4.

C1120 - results of research and development, which are recorded in account “04” (intangible assets).

C1130 - C1140 - indicators of exploration assets, both tangible and intangible (for companies that are users of subsoil, they reflect in these lines the costs used for the development of natural resources - PBU 24/2011, in accordance with Order No. 125n of the Ministry of Finance of our state) .

C1150 - basic type products. This line includes an indicator of the residual value of funds of the main type for depreciable objects, and for a non-depreciable object - an indicator of the initial cost. Those assets that are classified as funds of the main type must necessarily comply with PBU 6/01 (clause 4), according to Order No. 26n of the Ministry of Finance. The named objects are necessarily owned by the company or have the right of operational management or management. Funds of the main type also include property that a company receives on the basis of a leasing agreement and is subsequently recorded on the balance sheet of the recipient of this lease. Those objects that fall under mandatory registration as property rights also belong to the main type of funds (as soon as they are taken into account on the company’s balance sheet).

It is worth paying attention to the fact that in this section there is no reflection of expenses for the construction of real estate - the line “Construction in progress”. These expenses are entered in this line C1150 - PBU 4/99 (clause 20), in accordance with Order No. 43n of the Ministry of Finance. Although you can add an additional line to decipher expenses for unfinished construction.

C1160 - information about profitable investments in materiel. These, first of all, include the residual value of property that is rented out (that is, leasing), with subsequent accounting in account “03”. In the case when this property was used in connection with other production needs, and after that it will be rented out, then it is reflected in a separate subaccount of account “01” - the composition of funds of the main type. But the transfer of the cost of funds of the main type into profitable investments and vice versa is not carried out - letter No. GV-6-21/418@ Federal Tax Service (dated 05.19.05).

C1170 - financial investments of a long-term nature (for a period of more than 12 months), short-term ones are reflected in C1240 - this is section No. 2, line “Current assets”. Long-term investments include investments in subsidiaries. Financial investments are taken into account in the amount that was spent to acquire them. At the same time, the cost of their shares, which were purchased from the company’s shareholders for their subsequent resale or cancellation (C1320) + interest-free loans that are issued to the company’s workers, should not be classified as financial investments (C1190 - long-term type, C1230 - short-term type) - PBU 19 /02 (clause 3), in accordance with order No. 126n of the Ministry of Finance (dated 12/10/02).

C1180 - deferred tax assets must be contributed by income tax taxpayers (for the simplified tax system - “-”).

C1190 - indicators for other non-current assets, if they have not yet been included in other lines of section No. 1.

Section No. 2 - current assets.

C1210 is a digital indicator of the cost of inventories of a material nature; its decoding is required in the case when these indicators are included in C1210 (that is, they are significant). To decrypt, you need to add the following lines:

materials/raw materials;

costs of work in progress;

products in finished form, as well as goods for subsequent resale;

shipped goods.

C1220 is a digital indicator of value added tax, which is charged on purchased values. For those who work under the “simplified” system, filling out this line must be consistent with the company’s accounting policy, namely the amount of “input” VAT (reflected on account “19”), while such companies cannot be independent VAT payers - Tax Code , article No. 346.11 (clause 2).

C1230 - short-term receivables are registered, which require repayment within one year.

C1240 - financial investments, other than cash equivalents (loans provided to the company for a period of less than 12 months). When determining the current market value of investments, you must use all available information, including information from foreign trade organizers - letter No. 07-02-18/01 of the Ministry of Finance (dated January 29, 2009). If such a determination of the market value for an object that has already been assessed previously cannot be possible, then the value indicator is recorded based on the last assessment result.

The line “Cash and investments” sums up the digital indicators of the value of cash equivalents (the balance of the subaccount of account “58”) + account balances (accounts “50”, “51”, “52”, “55” and “57”). More information about cash equivalents can be found in the Regulations - PBU 23/2011, which is approved by Order No. 11n of the Ministry of Finance of our state (dated 02/02/11). For example, these are demand deposits that are opened in credit institutions.

C1260 - other current assets that were not included in other lines of this section No. 2.

Section No. 3 - capital and reserves.

C1310 - indicator of the amount of authorized capital:

share capital;

authorized capital;

friendly contributions.

The digital indicator for this line must coincide with the indicator recorded in the constituent documentation of the company.

C1320 - own shares or shares of the founders, previously purchased from the company’s shareholders, but not for sale (those that will subsequently be resold are included in C1260). They must be cancelled, resulting in a reduction in the authorized capital. Therefore, this indicator is written in parentheses, since it has a negative value.

C1340 - shows the revaluation of non-current assets. This is an additional valuation of objects that belong to fixed assets + intangible assets (account “83” - additional capital).

C1350 is a digital indicator of the amount of the additional indicator (it is taken without the revaluation amount from C1340).

C1360 - indicator of the reserve fund balance. Reserves include:

those that were formed at the request of the legislative system of our state;

those created according to constituent documents.

Decoding is not needed only if the listed indicators do not have a significant impact.

C1370 - shows the company’s accumulated profit over all years, which has not been distributed, and also includes an uncovered loss with a negative indicator.

The components of these indicators can be described in additionally added lines (this will be the decoding of financial performance - profit/loss).

Section No. 4 - long-term liabilities.

C1410 - long-term borrowed funds (that is, the repayment period is more than one year).

C1420 - income tax payers record information about deferred tax liabilities (those who work under the simplified tax system put “-”).

C1430 - estimated liabilities are recorded when the company recognizes them when maintaining accounting records - PBU 8/2010 (in accordance with Order No. 167n of the Ministry of Finance). This does not apply to small businesses.

C1450 - other long-term obligations that were not included in this section No. 4.

Section No. 5 - short-term liabilities.

C1510 - debt on borrowed funds of a short-term nature (that is, those that were taken out for a period of up to one year). This value should be reflected taking into account interest that must be paid at the end of the reporting period.

C1520 is a digital indicator of the total amount of debt on a short-term loan.

C1530 - information on income for future reporting periods. But this must be provided for in accounting regulations. Let's look at an example: a company receives certain amounts of money from the budget or amounts of targeted financing. Such finances are accounted for as deferred income. These are accounts “98” and “86” - PBU 13/200 (paragraphs 9 and 20), in accordance with order No. 92n of the Ministry of Finance of our state.

C1540 is a short-term estimated liability (similar to C1430), that is, filling occurs only when such liabilities are officially recognized in the accounting of the company itself.

C1550 - other short-term obligations that have not yet been included in other lines of section No. 5.

Information table: summary of balance sheet lines (general form)

|

Section number, name |

Line by line encoding |

Control |

|

No. 1 - non-current assets |

Dt04 (without R&D expenses) - Kt05 |

|

|

Dt04 (R&D expenses) |

||

|

Dt08 (expenses for intangible search costs) |

||

|

Dt08 (expenses for material search costs) |

||

|

Dt01 - Kt02 (depreciation of fixed assets) + Dt08 (expenses for construction in progress) |

||

|

Dt03 - Kt02 (depreciation of income-type investments) |

||

|

Dt58 + Dt 55 (sub-account “Deposit accounts”) + Dt73 (sub-account “Settlements on loans provided) - Kt59 (reserve for long-term financial investments) |

||

|

A digital indicator of the value of non-current assets, which are not taken into account in other lines of section No. 1 |

||

|

No. 2 - current assets |

The sum of the debit balances of the following accounts: 10, 11, 20, 21, 23, 28, 29, 43, 44, 45 + Dt41-Kt42+Dt15+Dt16 (or Dt15-Kt16)- Kt14+Dt97 (short-term expenses) |

|

|

Dt62+Dt60+Dt68+Dt69+Dt70+Dt71+Dt73 (not counting interest-bearing loans) +Dt75+Dt76-Kt63 |

||

|

Dt58+Dt55 (sub-account “Deposit accounts”) + Dt73 (sub-account “Settlements on loans granted”) - Kt59 (reserve for short-term financial investments) |

||

|

Dt50+Dt51+Dt52+Dt55+Dt57-Dt55 (sub-account “Deposit accounts”) |

||

|

Indicator of the value of current assets that were not included in section No. 2 |

||

|

S1200 (result for section No. 2) |

Sum of lines: C1210 to C1260 |

|

|

S1600 (balance) |

||

|

No. 3 - capital and reserves |

||

|

Kt83 (amounts of additional valuation of fixed assets and intangible assets) |

||

|

Kt83 (without amounts of additional valuation of fixed assets and intangible assets) |

||

|

S1300 (result for section No. 3) |

Sum of lines: from C1310 to C137 (the negative indicator of the result obtained is taken in brackets) |

|

|

No. 4 - long-term obligations |

Kt67 (excludes accrued interest, which at the time of drawing up the report has a maturity of up to one year, they are shown in C1510) |

|

|

Kt96 (only long-term estimated liabilities are taken into account) |

||

|

Long-term debt that was not reflected in other lines of section No. 4 |

||

|

С1400 (result for section No. 4) |

Sum of digital indicators of lines: from C1410 to C1450 |

|

|

No. 5 - short-term liabilities |

Kt66+Kt67 (this takes into account accrued interest with a repayment period of up to one year) |

|

|

Kt60+Kt62+Kt76+Kt68+Kt69+Kt70+Kt71+Kt73+Kt75 (only short-term debt is taken into account) |

||

|

Kt98+Kt86 (for targeted funding from the budget) |

||

|

Kt96 (only short-term estimated liabilities) |

||

|

Amounts of digital indicators of debts for short-term obligations that were not taken into account in other lines of section No. 5 |

||

|

С1500 (result for section No. 5) |

Sum of line indicators: from C1510 to C1550 |

|

|

S1700 (balance) |

S1300+S1400+S1500 |

If all data is entered correctly, the digital indicators of the following lines will be equal: C1600 = C1700. If the result does not match, then there is an error in the balance sheet.

An example of filling out a balance sheet form for the simplified tax system for 2016 (with a sample)

The Nadezhda company was registered as a limited liability company in the current year 2016. At the same time, she works in a “simplified” manner. We know the following data that will be required to complete the balance sheet:

An employee of the accounting department of Nadezhda LLC filled out the balance sheet form for 2016 using two forms - general and simplified.

The following key points will be common in filling out:

full company name;

type of main activity;

organizational and legal form;

type of ownership;

a unit of measurement that is not involved in calculations has been crossed out (in our case, all indicators are measured in thousands of rubles);

location of the company (its exact address);

coding system.

Dash marks are placed in both forms in the last two columns, since the Nadezhda company went through the registration procedure in the current year 2016. Therefore, only column No. 4 needs to be filled in, because the company is a newly created one. Information is recorded here as of December 31 of the reporting year (in our case, 2016).

Additionally, you should add column No. 3, in which the line-by-line encoding is recorded.

C1110 - intangible assets: Dt account “04” minus Kt account “05” = 100 thousand rubles - 3 thousand 340 rubles = 96 thousand 660 rubles (but since all digital indicators must be in the form of an integer, the number “ 97").

C1150 - funds of the main type: Dt account “01” minus Kt account “02” = 600 thousand rubles - 20 thousand 40 rubles = 579 thousand 960 rubles (the figure “580” is entered in the report).

C1170 - financial investments: Dt account “58” = 150 thousand rubles (such an investment will be of a long-term type).

C1100 - summary total: C1110+C1150+C1170=97 thousand rubles+580 thousand rubles+150 thousand rubles = 827 thousand rubles.

Entering data on current assets:

C1210 - inventories: Dt account “10” + Dt account “43” = 17 thousand rubles + 90 thousand rubles = 107 thousand rubles.

C1220 - VAT on purchased valuables: Dt account “19” = 6 thousand rubles.

C1250 - cash and equivalents: Dt account “50” + Dt account “51” = 15 thousand rubles + 250 thousand rubles = 265 thousand rubles.

C1200 - summary total: C1210+C1220+C1250=107 thousand rubles + 6 thousand rubles + 265 thousand rubles = 378 thousand rubles.

C1600 - total: C1100 + C1200 = 827 thousand rubles + 378 thousand rubles = 1205 thousand rubles.

All other lines in column No. 4 have “-”.

Now the sequence of filling out liabilities in the balance sheet.

C1310 - authorized capital: Account CT “80” = 50 thousand rubles.

C1360 - reserve capital: Account CT “82” = 10 thousand rubles.

C1370 - retained earnings and uncovered loss: Account CT “84” = 150 thousand rubles (since the indicator has a positive sign, it is not taken into brackets).

C1300 - summary total: C1310+C1360+C1370=50 + 10 + 150 = 210 thousand rubles.

C1520 - short-term accounts payable: Account credit “60” + Account credit “62” + Account credit “70” = 150 + 506 + 89 + 250 = 995 thousand rubles.

C1500 duplicates the C1520 indicator (this is due to the fact that the other lines of this section No. 5 remain unfilled).

C1700 - summary total: C1300+C1500=210+995=1205 thousand rubles.

The remaining passive lines have a “-” because there is no relevant information available.

The results of C1600 and C1700 are equal, this is 1205 thousand rubles. Since the balance in the report is correct, it means that the data was entered without errors.

Column No. 2 was added by the accounting employee himself in order to enter line-by-line coding into it. And column No. 3 contains digital indicators.

C1150 - cost of basic type funds = 580 thousand rubles.

C1170 - financial investments and non-current intangible assets: 97+150= 247 thousand rubles.

C1210 - inventories = 107 thousand rubles.

C1250 - cash and equivalents = 265 thousand rubles.

C1260 - current assets that are not included in other lines = 6 thousand rubles.

С1600 - summary result of the asset division: С1150+С1170+С1210+С1250+С1260.

Now let's look at the liability side of the balance sheet.

C1370 - retained earnings on the line “Capital and reserves”: 50+10+150=210 thousand rubles (calculated according to the indicator that has the largest share in the aggregated indicator).

C1520 - short-term accounts payable = 995 thousand rubles.

The other lines of column No. 3 remain with “-” because the information is missing. In column No. 2 you can also put “-” or enter the encoding corresponding to the indicator.

C1700 - total for liabilities: C1370+C1520.

Since when reconciling the results of the final lines - C1600 and C1700, we get the same number - 1205 thousand rubles, then the balance sheet is filled out correctly.

These forms are signed by a senior employee of the Nadezhda company. After this, the date of signing the documents is indicated.

Svetlana

Is it possible that Simplified accounting is provided on the old forms, Form for KND 0710096, and not on Form for KND 0710099