Late payment on a loan - what are the consequences? Does the bank have the right to charge interest on late payments? The procedure for submitting documents to the bank to reduce debt

Hello. For the use of someone else's funds due to their unlawful retention, evasion of their return, other delay in their payment, or unjustified receipt or savings at the expense of another person, interest on the amount of these funds is subject to payment. The amount of interest is determined by the discount rate of bank interest at the place of residence of the creditor, and if the creditor is a legal entity, at its location on the day of fulfillment of the monetary obligation or its corresponding part. When collecting a debt in court, the court may satisfy the creditor's claim based on the discount rate of bank interest on the day the claim was filed or on the day the decision was made. These rules apply unless a different interest rate is established by law or agreement.

Unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner specified in the agreement. If there is no provision in the agreement on the amount of interest, their amount is determined by the existing bank interest rate (refinancing rate) at the place of residence of the lender, and if the lender is a legal entity, at its location on the day the borrower pays the amount of the debt or its corresponding part.

2. Unless otherwise agreed, interest is paid monthly until the day the loan amount is repaid.

Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 1, 1996 No. 6/8:

The amount of interest payable for the use of someone else's money is determined by the bank interest rate existing at the place of residence of the creditor-citizen (location of the legal entity) on the day of fulfillment of the monetary obligation.

Currently, in relations between organizations and citizens of the Russian Federation, interest is payable in the amount of the uniform discount rate of the Central Bank of the Russian Federation for credit resources provided to commercial banks (refinancing rate).

The interest provided for in paragraph 1 of Article 395 of the Civil Code of the Russian Federation is payable only on the corresponding amount of funds and should not be accrued on interest for the use of other people's funds, unless otherwise provided by law.

Interest is payable for the entire period of use of someone else's funds on the day of actual payment of these funds to the creditor, unless a shorter period is specified by law, other legal acts or agreement.

If at the time of the decision the monetary obligation has not been fulfilled by the debtor, the court decision to collect interest from the debtor for the use of someone else's money must contain information about the amount of money on which interest is accrued; the date from which interest is calculated;

the amount of interest, based on the discount rate of bank interest, respectively, on the day the claim was filed or on the day the decision was made;

an indication that interest is accrued on the day of actual payment of funds to the creditor.

That is, it may also clarify the claims.

Many debtors who took out bank loans and were unable to repay them in full or in part think that after the lender files a lawsuit, this authority will sum up the results and set the final amount with interest. After this, the payment can be spread over several years. However, this is not always the case.

During the court hearing, the debtor has the right to make motions to cancel penalties and can count on installment payments of the principal debt. In some cases, the court goes to meet the debtor halfway, especially if he was able to prove the circumstances that his financial situation does not allow him to repay the entire amount borrowed at once. But the borrower’s “torment” may not end there yet, since after the trial the banking institution still charges interest on the balance of the debt.

Does the bank have the right to charge interest after a court decision is made?

Everything will depend on how the bank compiled its statement of claim and what demands it put forward. If a financial organization demands that the borrower repay the borrowed funds in full and at the same time decides to terminate the contract, then after the court makes a decision, interest is not accrued, and the total amount of debt is clearly recorded.

Recently, banking organizations have practiced filing claims in which demands are made to collect the amount of debt that arose only at the time of filing the application. In this case, the contract is not considered terminated as long as the main part of the debt remains outstanding. After this, the fines established by the contract continue to accrue on this balance and interest.

On what basis does the bank calculate interest after a court decision?

Based on Article 208 of the Code of Civil Procedure of the Russian Federation, the claimant has the right to submit an application to the court, on the basis of which, on the day the decision is made, an indexation of the amounts of money claimed through the court is collected. Interest for the use of other people's funds, their untimely payment and the receipt of unjust enrichment is accrued to the debtor on the basis of Article 395 of the Civil Code of the Russian Federation.

Based on these provisions of the law, a banking institution may demand interest from the loan recipient after paying a fixed amount of debt if the debtor pays the borrowed money in installments or does not fulfill its obligations on time. In this case, the bank must file a new claim in court, after which the borrower will have to pay a new amount of interest. But if the total amount of interest is small, the bank may refuse to file a new claim and leave the original debt unchanged.

Hello,

I heard a law was passed that banks do not have the right to do this from July 1, 2014

Not certainly in that way. On July 1, 2014, the Law “On Consumer Credit (Loan)” came into force (http://base.garant.ru/70544866/#block_5021).

According to clause 21 of Article 5 of the Law “On Consumer Credit (Loan)”:

Amount of penalty (fine, penalty) for failure to fulfill or improper fulfillment by the borrower of obligations to repay a consumer loan (loan) and (or) pay interest on the amount of a consumer loan (loan) cannot exceed 20% per annum if, under the terms of the consumer credit (loan) agreement, interest is accrued on the amount of the consumer credit (loan) for the corresponding period of violation of obligations, or if, under the terms of the consumer credit (loan) agreement, interest on the amount of the consumer credit (loan) for the corresponding period of violation of obligations is not accrued, 0.1 percent of the amount of overdue debt for each day of violation of obligations.

In other words, a “ceiling” has been established for fines and penalties.

The consequences of a borrower’s violation of the terms for repayment of the principal amount of debt and (or) payment of interest under a consumer credit (loan) agreement are given in Article 14 of the Law “On Consumer Credit (Loan)”:

1. Violation by the borrower of the deadlines for repayment of the principal amount of debt and (or) payment of interest under a consumer loan (loan) agreement entails liability established by federal law, the consumer loan (loan) agreement, as well as the emergence of the lender's right to demand early repayment of the entire remaining amount of the consumer loan (loan) together with the interest due under the consumer loan (loan) agreement and (or) termination of the consumer loan (loan) agreement in the case provided for in this article (Article 14).

2. If the borrower violates the terms of the consumer credit (loan) agreement in relation to the terms of repayment of the principal amount and (or) payment of interest for a duration (total duration) of more than 60 calendar days during the last 180 calendar days, the lender has the right to demand early repayment of the remaining amount of the consumer credit (loan) together with the interest due and (or) termination of the consumer credit (loan) agreement, notifying the borrower in the manner established by the agreement and setting a reasonable period for repayment of the remaining amount of the consumer credit (loan), which cannot be less than 30 calendar days from the date the creditor sends the notice.

3. In case of violation by the borrower of the terms of a consumer credit (loan) agreement concluded for a period of less than 60 calendar days, the deadline for repayment of principal amounts and (or) payment of interest for a duration (total duration) of more than 10 calendar days, the lender has the right to demand early repayment of the remaining amount of the consumer loan (loan) together with the due interest or termination of the agreement, notifying the borrower in the manner established by the agreement and setting a reasonable period for repayment of the remaining amount of the consumer loan (loan), which cannot be less than ten calendar days from the date notification by the creditor.

4. Responsibility measures cannot be applied to the borrower for violation of the deadlines for repayment of the principal amount of the debt and (or) payment of interest if the borrower complied with the deadlines specified in the last payment schedule under the consumer credit (loan) agreement sent by the lender to the borrower in the manner provided for in the consumer agreement credit (loan).

According to statistics provided by Vyacheslav Lebedev, Chairman of the Supreme Court, the number of requests from credit institutions to collect overdue debts has tripled over the past four years.

How does a bank collect a debt in court?

Order proceedings

Most often, the issue of loan repayment is resolved in writ proceedings. This comes with a number of benefits.

- The claim is heard in the magistrate's court (Article 23 of the Code of Civil Procedure), as a rule, at the location of the applicant (if the loan agreement allows this).

- The process costs twice as much.

- It takes a little time (about 15 days).

- The judge alone makes a decision in favor of the claimant, without proceedings or the presence of the parties, based on the documents presented by the applicant.

Claim proceedings

Less often, creditors resort to considering the case in a lawsuit. This is more expensive, takes a lot of time (2-5 months), it is desirable that both parties be present and have legal assistance.

But the claimant has no choice if:

- the amount of debt exceeds 500 thousand rubles (Article 121, paragraph 1 of the Code of Civil Procedure);

- there are controversial issues in the case;

- the debtor expressed disagreement within ten days from the receipt of the court order.

The issuance of a judgment does not mean that the amount of the debt is fixed. The bank continues to charge interest even after repayment of the amount specified in the court demand.

Why is this happening?

The creditor in the statement of claim demands repayment of the debt, which is determined on a specific date. For example, on May 1, the plaintiff filed an application demanding payment of a debt in the amount of 20 thousand rubles.

- The claim is accepted for proceedings within 5 days (Article 133 of the Code of Civil Procedure).

- Consideration of the case in court and making a decision can take from 5 days (writ proceedings) to 5 months (claim proceedings).

- Entry into force, 10 days.

- Total, at least 20 days.

During this period, interest continues to accrue, that is, on May 20, the debt will already increase. The defendant will pay 20 thousand rubles, but the creditor has the right to demand payment of interest accrued for 20 days (Article 395, paragraph 3 of the Code of Civil Procedure).

In addition, according to Art. 319 of the Civil Code, the payable debt will be repaid in the following order:

- expenses associated with debt collection (legal services, payment of state fees);

- interest;

- main debt.

Thus, the debt itself, on which penalties are charged, is written off last. If the borrower pays in installments or delays payments, interest will continue to accrue on the main body of the loan. The amount may increase significantly and the bank has the right to go to court again with a demand to repay it (Article 208 of the Code of Civil Procedure).

Therefore, it makes sense for the debtor to pay as quickly as possible so that the financial institution cannot index the awarded amount.

In some cases, the creditor goes to court demanding full payment of the debt and termination of the loan agreement. In this case, after a court decision is made, the contract is terminated, the amount of debt is fixed, and interest does not accrue. If the amount of interest accrued during the period of litigation turns out to be small, the bank may decide not to file a new claim and will leave the original amount unchanged.

But in practice, if the principal debt is not repaid, the creditor rarely terminates the contract on his own initiative. However, the borrower can do this himself by submitting such a proposal first to the bank (Article 452 of the Civil Code), where he will most likely be refused or offered restructuring, then to the court.

If the debtor, for example, has been seriously injured and is unable to work, or force majeure circumstances have occurred (fire), on the basis of Art. 451 clause 2 of the Civil Code, the court may treat the situation with understanding and terminate the contract. Of course, there is no absolute guarantee that justice will side with the borrower, but the help of a lawyer can increase this possibility.

As long as the loan agreement remains in force and the debtor has not fully repaid the debt, the creditor has the right to charge interest and demand payment.

If the lawsuit drags on for a long time, the debt may increase by a large amount and significantly worsen the situation of the defendant. In this case, it is better to seek help from a lawyer and, with his help, try to cancel the recalculation.

If the amount of the accrued debt turns out to be small, it is not profitable for the bank to collect it through the court; it is easier to sell it to a collection agency.

Currently, collection agencies operate strictly in . Their collection methods have become much softer and more civilized than a few years ago.

Collectors do not have the right to bother the debtor with frequent calls. Depending on the type of communication used, they can do this no more than 2-4 times a week (Article 7 of Federal Law-230). An agency employee is allowed to personally discuss the debt problem and the method of repayment with the borrower only once a week.

The debtor has the right to refuse contact with the new creditor or to carry it out through a representative (this can only be a lawyer) four months from the date of receipt of the demand for payment of the debt from the collection agency.

The law prohibits collectors (Article 6 of Federal Law-230):

- threaten to use physical force;

- cause harm to human health, life, property;

- use obscene or rude statements towards the borrower;

- mislead;

- communicate with third parties about the debt and the location of the defaulter (allowed only with written consent).

Only organizations included in the State Register of Collection Agencies have the right to interact with the debtor. You can view it on the official website of the FSSP. There you can also leave a complaint about illegal actions of debt collectors.

In addition, you can complain about the actions of debt hunters at your local office, on the NAPKA website, or to the prosecutor's office.

For the slightest violation of Federal Law 230, collectors are punished with large fines (maximum amount of 500 thousand rubles), suspension of activities for 3 months (Article 14.57 of the Administrative Code), exclusion from the register and revocation of the license.

It is also unprofitable for collectors to get involved in legal proceedings when the amount of debt is small. They send the debtor written demands for payment, call or offer payment in installments.

In most cases, the defendant manages to avoid paying interest accrued after the trial if the amount is small.

Bottom line

- The accrual of interest after a trial is a common situation, which often turns out to be an unpleasant “surprise” for the debtor. The amount specified in the court order has been paid, but the bank continues to demand money. It seems to the person that now he is forced to constantly pay and will never pay off the debt.

- The size of the requirements can be reduced if you review the loan agreement and demand explanations from the lender for each item.

- Often taking advantage of the legal and financial illiteracy of the borrower, the bank charges excessive penalties and penalties. In court, the amount of penalties can be significantly reduced). Challenge the commission for opening and maintaining a credit account, petition to cancel the debt recalculation, terminate the loan agreement.

- It is worth reviewing the order in which money paid to repay the debt is written off.

- The bank tries to write off fines and penalties for violating the terms of the contract first. By law, he can do this only after paying interest, costs and principal.

- During the trial, it is worth considering the possibility of concluding a settlement agreement. The debtor may ask the creditor for certain concessions, for example, writing off part of the accrued interest (up to 50%), stopping their accrual for a specified period in exchange for quick repayment of the debt. If the lender considers the borrower’s offer profitable, he will agree to a mutually beneficial agreement.

- In difficult situations, it is better to seek the help of a lawyer. He will tell you how to get rid of newly received demands as painlessly and profitably as possible.

This article will talk about all typical bank loans provided to individuals - consumer, auto, credit cards, mortgages - everywhere the legal basis is made up of contracts, everything else is mainly marketing names.

Consumer loan agreement

The texts of banking agreements are all standard. They are drawn up by a professional staff of lawyers, so an individual has to either agree and receive money (even if he does not agree with certain points of the document), or disagree and not receive it.

Although a loan agreement is, first of all, a document in the classical (legal) understanding of this term - that is, a set of rights and obligations of the parties who entered into it.

What other fines should you remember?

In conclusion of the article, I would like to note that there were, are and will be fines and penalties on the loan, since this is a certain form of responsibility for compliance with the contract.

The question is the size. In theory, high late payment fees are aimed at “intimidating” borrowers and reducing the level of overdue debt.

However, independent experts say that not everything is so simple and transparent. Sometimes an unscrupulous borrower is much more profitable for a bank than someone who pays on time. The fact is that, in accordance with the Civil Code and the terms of the contract, funds received from the debtor are primarily used to pay off fines, penalties, penalties, and only then to pay interest and pay off the principal debt.

But there is a decision of the Supreme Arbitration Court that in controversial situations, courts must take into account a different scheme: first, interest and principal are paid off, and only then penalties. How this will work in practice is still unclear. If you fundamentally disagree with the terms of the punishments before signing all the documents, it is useless to argue - no one will change the text of the document.

The only way is to change its terms in court after signing the loan agreement. There is a legislative basis for this - contract terms that infringe on the rights of consumers in comparison with the rules established by law are declared invalid. This norm is enshrined in Article 16 of the Law “On Protection of Consumer Rights”. At the same time, charging a fee for late payment is, in principle, completely legal, but under strictly defined conditions. Speaking of fines, judicial practice is such that if you had good reason not to pay the loan, then the courts, as a rule, reduce the fines and penalties accrued by banks to almost zero or to a reasonable amount.

Keep in mind that if you received a loan and then went to sue the bank, there is a risk that you will be blacklisted as “scandalous clients” and the loan received will be the last one in your life. It’s another matter if it was “sold” to collectors along with accrued premiums, or the bank has already put you on the list of unreliable borrowers and is demanding the entire amount in court - in this case, you should boldly sue.

Judicial practice in the collection of problem debts in recent years shows that in the event of a trial, the courts “write off” accrued fines, penalties and penalties presented by banks for collection from borrowers. “There are rumors” that there is a “tacit order” for the courts to write off such debt, because The state understands that insolvency on loans to citizens arose, among other things, due to the deterioration of the general economic situation in the country. BUT (I emphasize) that this is not a mandatory rule - formally, according to the Civil Code, the courts can impose penalties.

If for some reason you have an overdue debt and, accordingly, various sanctions have accumulated, then you can, of course, expect to go to trial and write off such debts. But recently, banks have been striving, on their own initiative, to reach an agreement with problem debtors - as a rule, it is proposed to refinance the problem debt - with more favorable conditions regarding the monthly payment. BUT the whole “trick” is that when refinancing, banks do not always write off accumulated penalties - they offer to formalize them as the principal debt under a new agreement. Accordingly, interest will be charged on them, etc. On the one hand, someone will say that this is a new financial “bondage”, on the other hand – a clean credit history, and you can and should get rid of increased obligations by earning more and repaying the loan early.

On July 1, 2015, the law on bankruptcy of individuals came into force - if you initiate this procedure, then according to the law, accrued fines and penalties can be written off, but the procedure itself is far from trivial, and the consequences for bankrupt citizens are generally clear .

There is another way out - companies have recently appeared that offer to buy your debt from the bank. The terms of such transactions do not apply - it all depends on the loan amount, the size of the problem liabilities, and the bank with which you will have to negotiate. But - after all, this is an option to resolve problem debt - and it must be used!

How to cancel fines and penalties on a loan?

For overdue loans, the bank charges colossal fines, sometimes comparable to the debt itself, and the amount of overdue increases in proportion to its duration. Some unscrupulous organizations deliberately delay contacting the client so that the amount of fines and penalties becomes as large as possible.

Changes in penalties provided for in Russian Legislation, in particular in the Civil Code of the Russian Federation in Article 333, which states that if the penalty is incommensurate with the consequences of non-compliance with the contract, the court has the right to change its amount.

If force majeure circumstances arise and it is impossible to fulfill his financial obligations to the bank, the client first needs to contact the lender and submit an application for the cancellation of fines and penalties that are provided for late payments on the loan.

However, not in all cases you can count on concessions; the bank takes into account only good reasons, which include:

- liquidation of the enterprise. A copy of the entry in the work book is required;

- abbreviation, also read similar article on this page,

- reduction in wages. You need to present a certificate; you can easily find out how to make a certificate of income on this page;

- temporary disability as a result of illness or accident. In this case, you will need a copy of the medical report and receipts for payment for medications;

- decreased income as a result of parental leave;

- death of a breadwinner whose family has disabled children. As documents, you will need copies of the death certificate of the parent and the birth of the children.

All events need documentary evidence, and the more significant they are, the better. This gives a chance for leniency towards the guilty debtor.

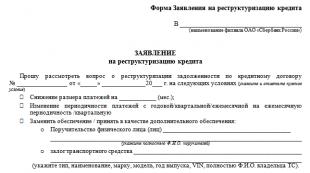

Depending on the severity of the situation, you can take advantage of credit holidays, debt restructuring, and in case of existing delays, the possibility of canceling fines and penalties. The first step is to visit a financial institution and write an application.

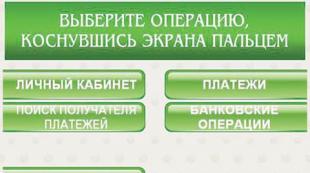

The procedure for submitting documents to the bank to reduce debt

Making a positive decision by the bank's management largely depends on the correctness of the application, the number of attached certificates and negotiations with employees of the credit institution.

- The application should indicate the reason for the debt and state a request to cancel the accrued penalties. The document should be handed to an employee of the lending department, who will most likely refuse to provide this service. In this case, you must issue a written refusal.

However, unfortunately, there are some failures, which can be justified or unjustified. In the first case, the management of the credit group believes that the reasons for the formation of debt are not compelling enough to cancel the penalty, and in the second case, the bank simply refuses to accept the client’s application.

If the bank does not agree to review the document, then it is obliged to notify the client in writing, which is the reason for applying to the judicial authorities. It is the responsibility of financial institutions to review and record any written request from a customer.

Instructions

Please remember that reducing or eliminating penalties for late payment - this is the bank's opportunity, not its obligation. When concluding an agreement, you should read its full terms, in particular those relating to the borrower's liability for late payments. And if you signed it, then you agreed to these terms, and must bear the corresponding penalty in the form of increased debt.

However, if the penalties accrued to you are very large and disproportionate to the size of the original debt, and the creditor refuses to defer or restructure the debt, then you have every right to go to court. If you can prove that you did not pay for a good reason, then the court will most likely side with you and reduce the amount of debt, and may also provide you with a deferment or a new payment schedule if necessary.

Also read about reducing fines on this page

Does the bank have the right to charge penalties on the loan after my application for loan repayment through the court?

Hello! I am unable to repay the loan in full. I submitted an application to the bank for loan restructuring. At the moment I have no debt and I am not refusing to repay the loan. I asked the bank to reduce the loan percentage (I have 39% per annum). After the refusal to restructure, I immediately wrote a statement to the bank stating that I was ready to resolve the issue in court. After my application, does the bank have the right to charge me fines and penalties if I pay the loan monthly, but in a smaller amount that I am still able to pay. Thank you in advance.

Lawyers' answers (2)

Your application does not oblige the bank to sue you. The bank has the right to do this whenever it wants. Fines and penalties will be charged even if you pay less than the prescribed amount.

Article 330. The concept of a penalty Yandex.Direct Are you hungry? Order pizza! dominos.ua/Order pizza Delicious and filling Dominos pizza. Delivery 30 min. Order! SaladsDrinksDesserts Loyalty program Kyiv 1. A penalty (fine, penalty) is a sum of money determined by law or contract that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in the case of delay in fulfillment. Upon a claim for payment of a penalty, the creditor is not required to prove that he suffered losses. 2. The creditor has no right to demand payment of a penalty if the debtor is not responsible for non-fulfillment or improper fulfillment of the obligation. Commentary to Art. 330 of the Civil Code of the Russian Federation 1. Penalty is one of the most common ways to ensure the fulfillment of obligations both in relations between legal entities and in relations between legal entities and citizens. In legal relations between citizens, penalties are relatively rare. Source: stgkrf.ru/330

Unfortunately, the bank has the right to both refuse to restructure you and continue to charge interest under the terms of the concluded agreement. If you now begin to make monthly payments below the established amount, then the bank will have the opportunity to charge you a penalty for the unpaid amount; in addition, most loan agreements provide for the right to demand early repayment of the loan amount in cases of repeated violation of obligations by the borrower. It is best for you to once again send an application for debt restructuring to the bank and attach your calculation of the monthly payments that are feasible for you. You can go to court yourself to avoid penalties being charged to you. During the trial, it will be necessary to confirm the difficult financial situation, for example, with a 2-NDFL certificate from work. Also consider refinancing.

Looking for an answer?

It's easier to ask a lawyer!

Interest charged by a bankrupt bank

Does a bankrupt bank (license revoked by the Central Bank in February 2016, declared bankrupt in April 2016) have the right to charge interest and penalties on a loan for several years in 201 and sue for reimbursement of these interests?

Lawyers' answers (4)

Unfortunately, he has the right, since bank bankruptcy itself does not suspend the validity of the loan agreement, and therefore all provisions of the loan agreement, including the accrual of interest on the loan and penalties for late payment, will remain in effect.

Sincerely,

Oleg Ryabinin.

in 201, accrue interest and penalties on the loan for several years and sue for reimbursement of these interests?

Good evening, the bank has this right, but you need to check whether the statute of limitations has expired, it is calculated for each payment separately and is 3 years

Civil Code of the Russian Federation Article 196. General limitation period

1. The general limitation period is three years from the date determined in accordance with Article 200 of this Code.

If the statute of limitations has been missed, then you have the right to petition to skip the statute of limitations, as well as to reduce penalties under Article 333 of the Civil Code of the Russian Federation

What should a borrower do after the bank’s license is revoked?

Do I need to repay a loan to a bank if its license has been revoked?

Revocation of a license does not cancel the obligation of bank borrowers to repay debt in accordance with the terms of loan agreements. If the borrower stops servicing his debt, the bank has the right to go to court to forcibly collect the debt.

In what order is the loan repaid?

During the period from the date the Bank of Russia revokes a credit institution's license to carry out banking operations and until the arbitration court makes a decision to declare the bank bankrupt (liquidation), the borrower is obliged to repay the loan debt in the manner and according to the details established by the temporary administration for managing the bank. The relevant information is posted by the temporary administration on the bank’s website or provided at its location. In the absence of such information, the borrower is obliged to repay the loan debt according to the payment schedule approved by the agreement using the previous details.

After the arbitration court makes a decision to declare the bank bankrupt (liquidation) and assigns the functions of a bankruptcy trustee (liquidator) to the Deposit Insurance Agency, the borrower is obliged to repay the debt according to the details posted on the Agency’s website http://www.asv.org.ru/ in the section “Liquidation of banks” on the page of the relevant bank. Such information is published no later than 10 days after the opening of the liquidation procedure. In addition, the bankruptcy trustee (liquidator) sends letters to all borrowers indicating payment details for debt repayment.

Payment of loans to individuals in cash WITHOUT COMMISSION is also provided at the terminals of JSCB "Russian Capital" (PJSC), installed at the following addresses: Moscow, Vysotskogo St., 4 (former Verkhniy Tagansky dead end); Lesnaya st. 59, building 2.

To make a payment, the following data is required: name of the Bank, number and date of the loan agreement, full name of the Borrower, telephone number of the Borrower. A one-time payment should not exceed RUB 15,000.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 12, 2001 No. 15 and Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 15, 2001 No. 18 “On some issues related to the application of the norms of the Civil Code of the Russian Federation on the limitation period.” In particular, lawyers operate with the following rules:

"10. The limitation period for a claim arising from a violation by one party of the contract of the terms of payment for goods (work, services) in installments begins in respect of each individual installment from the day when the person learned or should have learned of the violation of his right. Statute of limitations for claims for overdue time payments (interest for the use of borrowed funds, rent, etc.) calculated separately for each overdue payment.”

"25. Limitation of actions to collect interest, paid by the borrower for the loan amount in the amount and in the manner determined by paragraph 1 of Article 809 of the Civil Code of the Russian Federation, expires at the time of expiration of the statute of limitations on the demand for repayment of the principal amount of the loan (credit)…. »

You must submit written objections to the statement of claim.

Can a bank charge penalties or fines on a loan after a court decision indicating the exact amount?

The situation is this: I still had a debt on the loan since 2008 - the last payment was 1,526 rubles. I only learned that the debt had not been repaid and that there was a court decision when I was sorting out the documents after the death of my ex-husband. There was a court document (order) according to which I was obliged to pay the specified amount. I paid this amount at the bank, the operator checked my personal account and said that my loan had been repaid and I didn’t owe anything else. But then I received a letter from an unknown organization demanding to pay off the debt, or rather fines and penalties in the amount of 10,000 rubles. Then calls began threatening to take inventory of property and so on. My questions are the following: in the event of transfer of obligations to a collection agency, should the bank notify me about this; and if the court, as in my case, has clearly stated the amount to be paid, can the bank then assess any penalties and fines or is that the only amount payable?

I just don’t understand yet who is demanding this money, because the bailiffs have never contacted me during all this time and I have no information about the debt at all.

Lawyers' answers (3)

Have a question for a lawyer?

Try to understand this situation; perhaps this is an error, and you should, if possible, raise all payment documents for depositing funds into the loan account.

Request from the bank a statement of your account from which the loan was repaid.

If you paid the loan amount from the bank and did not take a certificate of full repayment of the loan, then ask the bank for an official certificate of full repayment of the loan certified with the appropriate signature and seal; the bank has no right to refuse to provide you with such a certificate if the loan has actually been fully repaid.

Regarding threats from so-called collection agencies

You have the right to contact the Federal Service for Supervision of Consumer Rights Protection (Rospotrebnadzor) with a complaint about the “organization” that is pestering you with threatening calls; there may be dishonesty in demanding fines, not to mention the threat of taking an inventory of property.

By virtue of Art. 388 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), the assignment of a claim by a creditor to another person is permitted if it does not contradict the law, other legal acts or an agreement. In addition, the bank was obliged to notify you of the assignment of the claim to the “organization” that is terrorizing you, unless other conditions were stipulated in the loan agreement in your favor.

Resolve issues related to the loan only with the bank, and not with a suspicious “organization.” If the bank refuses to provide you with a certificate of loan repayment, write a claim to the bank, and then go to court.

You need to challenge the court order to collect the debt. The period for appeal is 10 days from the date of receipt. The grounds for appeal are that YOU do not agree with the debt and have paid everything.

The bank should have notified you of the assignment of the right of claim to a collection agency. This notice must indicate the amount that was transferred to debt collectors. If you have not received such a notification, then you don’t have to pay anything to the collectors.

You need to talk to the bank about repaying your loan. Have all payments been made?

You can file a police report against collectors about extortion. After this, collectors will be calmer.

Ask our lawyers a question - it’s much faster than looking for a solution.